Portside weakness drags down PBF premiums

PBF traded at a floating premium of $4.50/dry metric tonne (dmt) to the November 62pc index on 7 October. December-indexed cargoes traded at premiums of $2.35-2.50/dmt last week, although this week sellers are struggling to achieve a $2/dmt premium.

UK-Australian mining firm Rio Tinto was offering PBF cargoes at a $2/dmt premium off screen yesterday, but buyers were only willing to pay $1.50/dmt. A second half-December loading cargo traded at a $1.50/dmt premium off screen on 8 November. These are vessels fully loaded with PBF, as PBF parcels paired with PB lump trade at a lower premium.

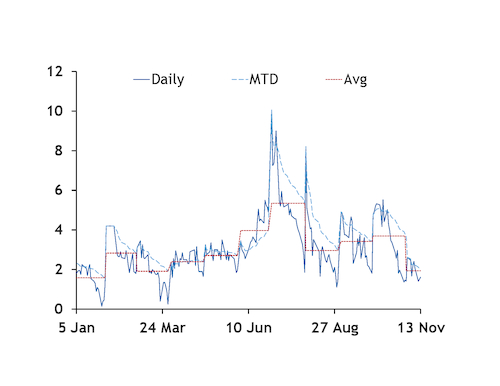

The month-to-date average of the Argus PBF implied floating premium index broke below $2/dmt for the first time since March yesterday, off levels as high as $4-5/dmt in October. The October average finished at $3.69/dmt, pulled lower by late-month falls. Implied floating premiums are the difference between the Argus value-in-market PBF 62pc basis outright price and the prompt-month forward price.

The month-to-date $2/dmt level has acted as support for PBF premiums this year, Argus data show, possibly indicating limited downside for premiums.

But for now implied premiums from fixed price trades and participants' tradeable levels are below $2/dmt. A cargo of PBF with 12-21 December traded off screen at $80.60/dmt on 62pc basis yesterday, equal to a floating premium of $1.30/dmt against December paper. Cargoes of PBF with early and mid-December laycans were offered today off screen at premiums of $2/dmt and $1.50/dmt respectively.

Portside drives PBF weakness

PB fines traded at around 670-680 yuan/wet metric tonne (wmt) in late October in Tangshan and Shandong ports, but then fell by around Yn5/wmt each day to Yn615-625/wmt on 12 November. They then rebounded yesterday to Yn620-622/wmt at Shandong and Yn623-625/wmt in Tangshan.

The slide in prices has made buyers cautious about stocking up on the ore, while sellers are anxious to clear out stocks before the fiscal year ends in December.

Some trading firms, including some large-scale ones, with tight cash flows are offering up to a Yn10/wmt discount on list prices to push sales.

A few deals for 61.34pc Fe PB fines were done at Yn627/wmt at Jingtang port on 8 November. Sales were at Yn620/wmt and Yn623/wmt in Shandong and Tangshan ports respectively on 11 November and at Yn615-620/wmt at these ports the following day.

Some trading firms that had bought October 62pc index-linked PB fines cargoes are finding it hard to cut prices any further, as they are already selling cargoes at a loss in the portside markets, said a Shanghai-based trader.

The Argus PBF portside price has averaged Yn644/wmt free-on-truck (fot) Qingdao in November, or a seaborne equivalent of $84.25/dmt, down from an October average of Yn709.73/t.

The Argus ICX 62pc index averaged $89.61/dmt in October. Even at a low floating premium of $2.50/dmt for PBF delivered in October indexed to the ICX, a portside trading firm's costs will be around Yn700/wmt. PBF fot Qingdao was Yn619/wmt yesterday, Yn81/wmt below this conservative cost estimate. Many PBF floating deals traded above $3/dmt in October.

For December-indexed seaborne cargoes now selling in seaborne market, the cost to land at the port and sell on a fot basis has been around Yn620-630/wmt with a floating premium of $2-2.50/dmt.

PB fines is among the most liquid of imported fines sold in the Chinese market and often serves as a proxy for overall iron ore demand. Iron ore demand typically weakens in the winter months, although few expect demand to fall rapidly as demand for steel from the real estate market remains robust. Some steel mills typically swap iron ore in blast furnace burden with more scrap in the basic oxygen furnace. But such replacement was much lower in 2018 compared with 2017 as cities were lax in enforcing steel production and sintering restrictions. Details are still awaited on winter restrictions on steel output in the main producing cities.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

NextSource soars on Mitsubishi Chemical offtake deal

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF