Turkey: Imported Scrap Prices Inch Up in Recent Bookings

In recent deal reported, a major US based supplier sold a bulk vessel to an Aegean region-based steel mill, comprising of HMS 1&2 (80:20) at USD 260 /MT, shredded at USD 265 /MT and bonus grade at USD 270 /MT, CFR Turkey.

Another steelmaker based in Mediterranean region also booked a bulk vessel from the same supplier with 30,000 MT mixed cargo, comprising of 18,000 MT of HMS 1&2 (80:20) at USD 260/MT, CFR, and 12,000 MT of shredded scrap at USD 265 /MT, CFR Turkey.

Further, an Aegean region-based mill concluded a bulk vessel from USA scrap yard, booking HMS 1&2 (80:20) at USD 260 /MT, shredded at USD 265/MT and bonus at USD 270/MT CFR level.

Earlier this week, a Mediterranean region based steelmaker in Turkey concluded a bulk vessel this week from a USA based scrap recycle yard booked a 31,000 MT of mixed cargo, comprising of 22,000 Mt of HMS 1&2 (90:10) at USD 262/MT CFR, and 9000 MT of shredded at USD 265/MT, putting HMS (80:20) price at USD 260/MT.

Prior to this, at the closing of last week, a Turkish steelmaker concluded a bulk vessel yesterday from a US-based recycle yard, booking a mixed cargo comprising of HMS 1&2 (80:20) at USD 259/MT CFR, and bonus scrap at USD 269/MT CFR Turkey.

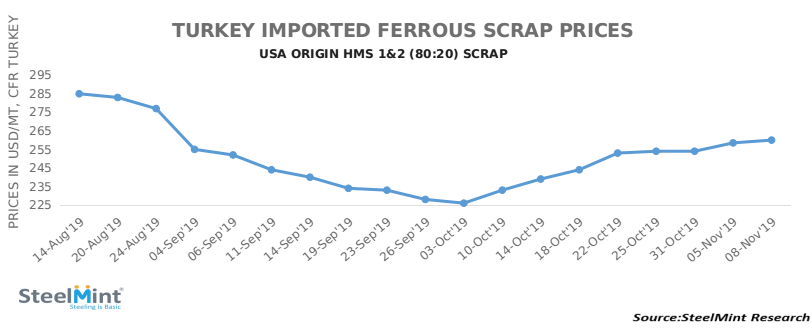

As per SteelMint’s methodology, assessment of US-origin HMS 1&2 (80:20) scrap has inched up marginally by USD 2/MT W-o-W and stands at USD 260/MT, CFR Turkey, against the last report in the opening of this week. The assessment of European origin HMS 1&2 (80:20) now stands at around USD 254/MT, CFR Turkey.

Turkish rebar export prices this week stand at around USD 415-420/MT FoB, slightly up on higher scrap costs.

Codelco seeks restart at Chilean copper mine after collapse

Hudbay snags $600M investment for Arizona copper project

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling