Winter pollution targets set for central, east China

The Yangtze river delta region will need to cut its PM2.5 particulate matter by 2pc, while the Fenwei region was given a PM2.5 target cut of 3pc, said China's ministry of ecology and environment. The number of heavy pollution days must also fall by 2pc and 3pc respectively. The Yangtze river region will impose additional output limits on blast furnace-based steel producers that had capacity utilisation of more than 120pc of their nameplate capacity in 2018.

The plans cover industrial regions in central and east China including Shanghai, Jiangsu, Zhejiang, Anhui, Shanxi, Shaanxi and Henan. The targets are looser than last winter and without specific requirements for steel mills, although the plans raised expectations for winter supply cuts. January steel futures rose immediately after the plans were released, with hot-rolled coil prices closing up by 1.8pc at 3,380 yuan/t and rebar up 2.4pc to Yn3,449/t.

Beijing last month announced October-March winter target cuts for its north China industrial belt that includes the steel-producing Tangshan hub. The Beijing-Tianjin-Hebei region will need to cut its PM2.5 emissions by 4pc and heavy pollution days by 6pc.

Today's targets announced for Yangtze river delta and Fenwei are less than the required cuts of 3-4pc last year.

Mills in all three regions are still waiting for specific requirements from local governments. Tangshan will again use a tiered system based on installed emission controls, but Hebei has not released details on its plans yet.

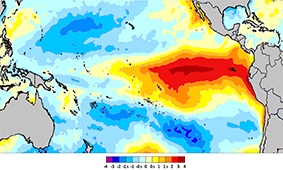

In a repeat of last winter, El Nino conditions forecast for this winter will be less conducive to dispersing pollution, adding pressure on pollution controls to offset the negative weather conditions, policymakers said.

El Nino conditions increase the likelihood of windy weather. China was able to reduce PM2.5 emissions by 25pc in the 2017-18 winter, aided by strong winds that accounted for a third of the reduction.

While the overall targets are relaxed from last year, steel supplies are tighter with steel inventories falling at a moderate pace, which could support prices, a Hebei mill iron ore buyer said. Output restrictions will reduce iron ore demand, but "news about restrictions support the steel price, which then supports the iron ore prices. It is always this logic", an east China-based steel mill manager said.

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds