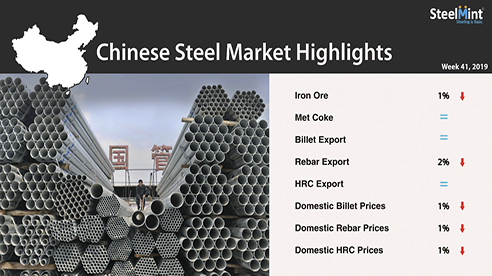

Chinese Steel Market Highlights- Week 41, 2019

Nation’s HRC export offers remained stable amid moderate domestic demand. While Rebar export offers declined following a decline in domestic prices. Along with this, Billet export offers remain range-bound despite a fall in domestic prices. Spot iron ore prices declined due to higher inventories.

Also this week, the Chinese govt has announced fresh rounds of production curbs in the Tangshan region on 9 Oct'19. As per the recent announcements, 29 out of 33 local steel mills have to suspend their blast furnace operations by no less than 50% on an average during the 10-31 Oct period.

Meanwhile, China's major steel-maker Baosteel announced an increase of RMB 100/MT for HRC (Q420E-HZ), however, it kept prices stable for other grades.

Chinese spot iron ore declines amid oversupply- Chinese spot iron ore prices opened up this week at USD 93.90/MT, CFR China and dropped to USD 92.65/MT, CFR China towards the weekend. Prices have dropped down amid reduced demand witnessed post Golden Week holidays in China due to rising inventory at Chinese ports.

As per data compiled by SteelHome consultancy, Iron ore inventory at major Chinese ports increased by 4.4 MnT to 129.95 MnT as compared to 125.55 MnT towards Sep’19 end. The iron ore inventory reached almost 5 months high as the level was last witnessed towards mid-May at 131.7 MnT.

Spot pellet premium up marginally- Spot pellet premium for Fe 65% grade pellets assessed at USD 17.65/MT, CFR China as against USD 17.05/MT, CFR China assessed towards Sep’19 end. Production curbs were heard being extended in Tangshan which placed 50% operation limit on average over October 10-31.

Spot lump premium moves up on a weekly basis- Spot lump premium picked up to USD 0.1900/DMTU as against USD 0.1450/DMTU towards the end of last month. The rise is due to recovery in lump demand by Chinese mills. However, a further increase in lump premium may reduce the cost efficiency of lump over pellets rendering shift towards pellets.

Coking coal offers witness rebound after the National Day holidays- Seaborne hard coking coal prices jumped by USD 11/MT against the previous week owing to the resumption of trade activities in China post-Golden Week holidays. However, no major deals have been reported yet as buyers are eyeing for lower offers.

Meanwhile, demand from Indian steel mills continues to remain gloomy with weakening steel prices and bearish sentiments prevailing in the domestic market.

Thus, the latest offers for the Premium HCC grade are assessed at around USD 148.75/MT FoB up by USD 11.75/MT W-o-W basis which was USD 137.00/MT FoB basis in the previous week.

Chinese domestic billet prices continue to move down- Nation’s domestic billet prices settled at RMB 3,390/MT, down RMB 20 against RMB 3,410/MT in the preceding week. Market sentiments were reported fragile this week.

Chinese HRC export offers remain moderate- Nation’s HRC export offers remained stable during the week amid low priced imports to Vietnam from Indian and Russia. Indian steel mills are aggressively exporting HRC to Vietnam by offering competitive prices.

Meanwhile, pessimistic sentiments in the Russian domestic market propelled steelmakers to reduce export offers for South-East Asian nations.

Thus, Chinese HRC export offers remain largely stable post-National day holidays. Currently, the nation’s HRC export offers are hovering at USD 450-455/MT FoB stable over the previous week.

However domestic HRC prices moved down by RMB 20/MT to RMB 3,570-3,580/MT as compared to RMB 3,590-3,600/MT in Eastern China (Shanghai) in the previous week.

Chinese Rebar export offers decline amid higher inventory- Nation’s rebar export offers witness drop amid higher inventories available amongst mills in China. Also, the gap between offers and bids led to a fall in rebar export offers this week.

Currently, the nation’s rebar export offers stood at USD 455-460/MT FoB China down by USD 10/MT in comparison with USD 465-470/MT FoB China in the previous week.

Meanwhile, domestic rebar prices stood at RMB 3,700-3,730/MT (Eastern China) down by RMB 20/MT as against RMB 3,720-3,750/MT (Eastern China) a week ago.

Also, inventory build-up due to increased production will lead to bearish market sentiments and pull down rebar prices in the near-term.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge