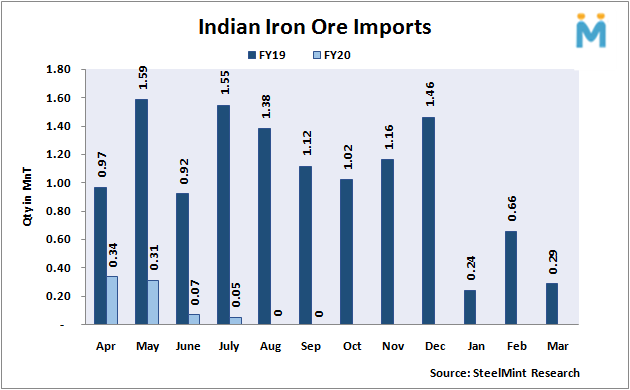

Indian Iron Ore Imports Continue to Remain Nil in Sep’19

Monthly average iron ore prices stood at USD 93/MT, CFR China in Sep against previous month at USD 92/MT, CFR China. Although the spot iron ore fines (Fe 62%) index witnessed drop in past few months against USD 120/MT, CFR China assessed towards July’19. However, it is still non-viable to import iron ore on falling domestic sponge and semi-finished steel prices.

Why have Indian iron ore imports recorded nil for the month?

1. Competitive domestic iron ore prices:

Indian domestic miners slashed prices in Sep’19. NMDC reduced iron ore lumps and fines prices by INR 200/MT and DRCLO INR by 230/MT from Chhattisgarh mines, and from Karnataka mines reduced prices INR 300/MT in both fines and lumps. Also, major Odisha miners increased discount for bulk iron ore fines booking and Serajuddin mines reduced lump offers by INR 300/MT.

2. Domestic pellet preference over imported South African lumps:

Imported South African lumps inquiries in India continued to remain slow last month as the domestic pellet was more preferable. West India based steel mills preferred domestic pellets.

SteelMint's assessment for South African lump witnessed at around USD 103-105/MT, CFR India towards end of Sep against USD 120/MT, CFR China towards end of Aug’19. However, the prices are still unviable for purchases. Domestic pellet offers of Jindal SAW for Fe 63% grade were assessed at INR 8,050/MT del Kandla in end Sept'19 against INR 7,500/MT a month ago.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge