India: Imported Scrap Prices Remain Range-bound in Recent Trades

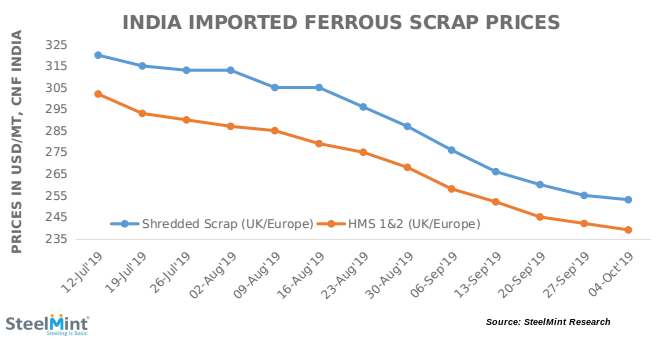

SteelMint’s assessment for containerized Shredded from the UK, Europe and USA to India stands at USD 250-255/MT, CFR Nhava Sheva, slightly down by USD 3-4/MT against last week's report. A major global supplier sold around 5,000 MT of Shredded scrap this week, at around USD 254-255/MT CFR, while few suppliers from Europe even offered at price level USD 3-4/MT lower.

HMS scrap offers too remained in a similar range as last week, with HMS 1 offers from Dubai being reported at around USD 250-255/MT, CFR while HMS 1&2 (80:20) offers from European & Australian origin were reported in the range of 237-240/MT CFR. A South East Asia based supplier sold 1000 MT of Australian origin HMS 1 for USD 240/MT, CFR Nhava Sheva.

Few trades for West African origin HMS were heard to Goa, at USD 245/MT CFR Goa, translating to 235/MT CFR Nhava Sheva, while South African HMS 1 remained at USD 260/MT level.

Earlier this week, it was confirmed that a USA (west coast) based yard had sold a bulk cargo vessel to a Gujarat based steelmaker, comprising of 25,000 MT of Shredded scrap and 7,000 MT of Bonus scrap for a total of 32,000 MT of scrap, at an average price of USD 261/MT CFR Kandla. The shipment is expected for November 2019.

Indian domestic scrap prices fall slightly - Local scrap offers in India dropped all through the week, as falling prices of Sponge Iron offered little support. The current assessment of local HMS 1&2 (80:20) stands at INR 20,900/MT (USD 294) ex Mumbai, while Chennai based HMS 1&2 (80:20) assessed at INR 19,400/MT (USD 274) ex-works, falling by INR 400-600/MT on a weekly basis.

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project