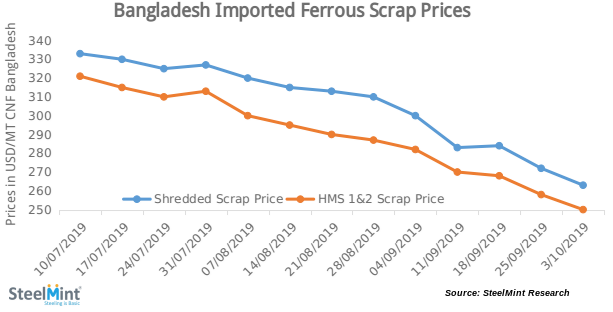

Bangladesh: Fall in Bids Put Imported Scrap Offers Under Pressure

SteelMint’s assessment for containerized Shredded scrap from Europe and North America stands in the range of USD 260-265/MT, CFR Chittagong, down by another USD 5-10/MT against last week’s report. Few deals were reported at around USD 262-263/MT CFR, however, most buyers had kept their bids lower, remaining watchful of the ongoing downtrend.

HMS scrap prices witnessed a sharper drop this week, with HMS 1&2 (80:20) from Brazil and European origins being offered at around USD 250/MT CFR, down by around USD 8/MT w-o-w, with a further drop being expected on account of lower buying interest. Offers for higher quality HMS 1 from South African and Australian Origin now stands at USD 255-256/MT CFR, falling by USD 10/MT on a weekly basis.

P&S offers from Brazil and other South American origins plunged sharply amid limited interest from buyers, currently standing at around USD 265/MT CFR, almost on par with Shredded scrap offers.

Domestic scrap prices observes stability - After observing sharp decline for several months successively, Local scrap prices seem to have witnessed slight strengthening this week, on account increased demand and tightening of supply. Currently, the shipyard scrap in Chittagong market is being offered at around BDT 30,500-31500/MT (USD 361 -372 ) ex Chittagong, up by BDT 500-1000/MT. On the other hand, LMS bundles (substitute of Sponge Iron) are being offered at around BDT 26,000/MT, while ship plates of 12mm and 16mm are being traded at around BDT 40,500/MT and 41,500/MT ex Chittagong respectively .

The domestic finished steel market remains slow as the continuing of heavy monsoon and floods in northern regions has kept demand from construction sector limited, while a further fall in prices of domestic billet and global scrap are also likely to affect finished steel prices in coming days.

Codelco seeks restart at Chilean copper mine after collapse

Hudbay snags $600M investment for Arizona copper project

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling