Chinese Steel Market Highlights- Week 39, 2019

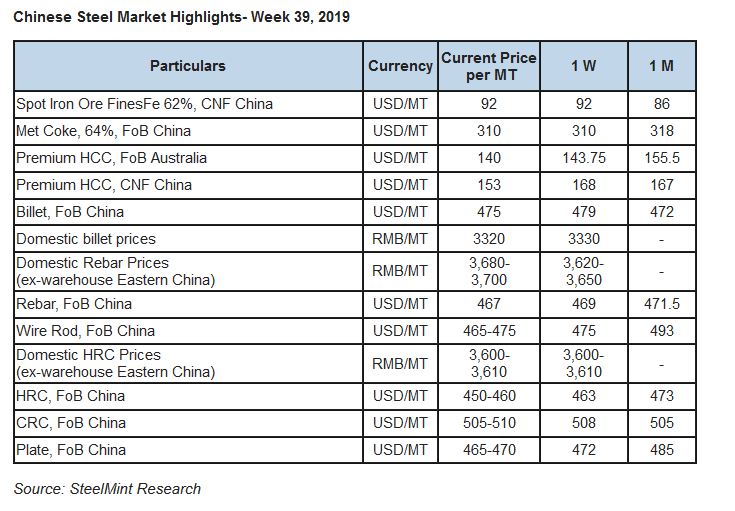

China’s HRC export offers fell however, rebar export offers remained largely supported ahead of Golden Week holidays. Iron ore prices remained firm on a weekly basis. However, billet export offers witnessed a marginal decline.

Chinese spot iron ore remains unchanged on a weekly basis- Chinese spot iron ore prices opened up this week at USD 93.65/MT, CFR China and dropped to USD 91.5/MT, CFR China towards the weekend similar to the prices in the previous week. Prices have dropped down amid rising port stocks.

As per data compiled by SteelHome consultancy, Iron ore inventory at major Chinese ports increased to 125.55 MnT as compared to 124.1 MnT a week ago.

Spot pellet premium up W-o-W- Spot pellet premium for Fe 65% grade pellets assessed at USD 17.05/MT, CFR China as against USD 12.15/MT, CFR China a week before.

Pellet premium has witnessed rise after production curbs announced in China.

Spot lump premium remains firm on a weekly basis- Spot lump premium picked up on a weekly basis to USD 0.1450/DMTU as against USD 0.1260/DMTU assessed last week. The rise is due to recovery in lump demand by Chinese mills.

Coking coal offers slide further on a weekly basis- Seaborne hard coking coal prices plummeted this week, amid an oversupply of lower quality seaborne cargoes and import restrictions in Chinese ports. However, traders remain concerned about further drop in demand with the import quotas nearly exhausted at ports.

In India, the demand has been dampened by the prevailing bearishness in the domestic steel sector.

The latest offers for the Premium HCC grade are assessed at around USD 137.00/MT FoB fell by USD 6.75/MT W-o-W basis which was USD 143.75/MT FoB basis in the previous week.

Chinese domestic billet prices slide further- Yesterday the billet price in Tangshan, Changli, and QIan'an was settled at RMB 3,320 ex-factory, including tax. Today the Changli area saw price uptick by RMB 20/MT to RMB 3,340/MT. Most finished steel prices tend up with some resources stabilized.

Chinese HRC export offers declined amid increased overseas competition- This week Chinese HRC export offers witnessed a decline of around USD 10/MT as low priced imports to Vietnam from India and Russia keep weighing on the Chinese origin HRC offers.

Currently, the nation’s HRC export offers are hovering at USD 450-460/MT, FoB as against USD 460-465/MT in the previous week.

Domestic HRC prices kept hovering at RMB 3,600-3,610/MT in Eastern China (Shanghai).

Chinese Rebar export offers remain supported on a weekly basis- This week Chinese rebar export offers remained largely stable amid restocking in the domestic market ahead of the Golden Week holidays.

However, overseas buyers stick to the wait and watch approach in anticipation of lower offers from Chinese mills.

Currently, the nation’s rebar export offers stood at USD 465-470/MT FoB China which was USD 464-474/MT FoB China in the previous week.

Meanwhile, domestic rebar prices stood at RMB 3,680-3,700/MT (Eastern China) as against RMB 3,620-3,650/MT (Eastern China) a week ago.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Goldman told clients to go long copper a day before price plunge

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project