Finish Long Trades Improve in Indian Secondary Steel Market

The buyers have booked hefty volumes following surge in price range. Hence the mills don't have much selling pressure in most of locations.

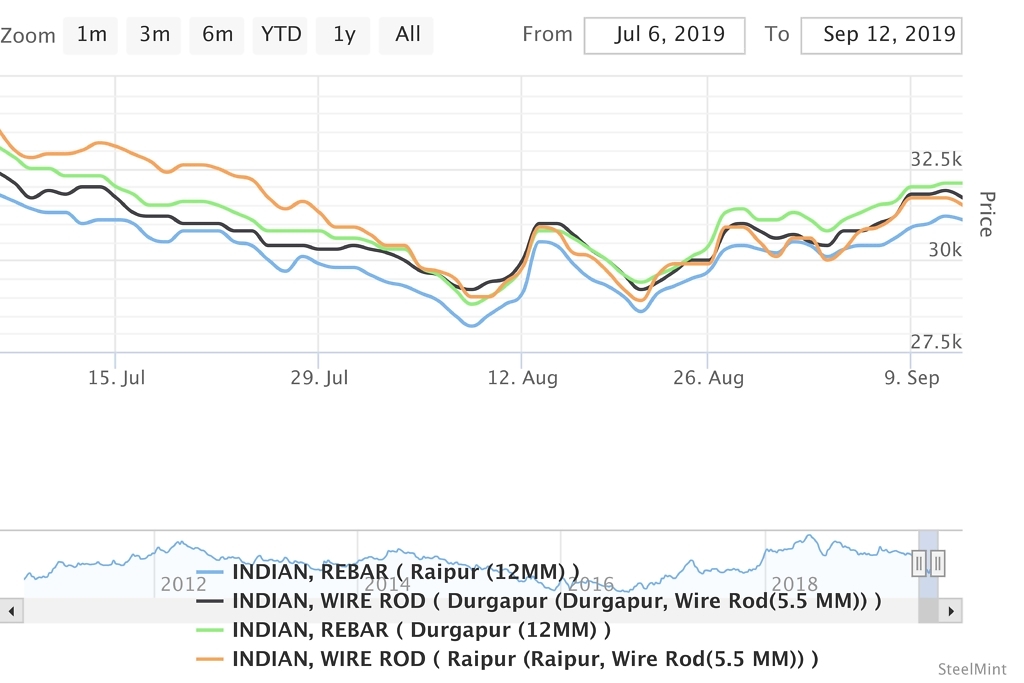

The price range of rebar, structural steel & wire rod surged upto INR 1,000/MT (USD 14) across regions except in western India, where festive mood along with heavy rains have negatively impacted lifting of finished steel during the week.

REBAR

-- Jalna (located in Maharashtra) the secondary major mills here have cited average stock amid curtailed production level by 30-50% along with slight improved demand which has narrowed down inventories.

-- Further, the mill owners in Raipur, Raigarh, Rourkela & Durgapur stated no major unsold stock and the lifting of recent bookings are active from the neighboring states including local market as well. The production utilization is Raipur is about 50-70%, meanwhile in Durgapur the plants are operational in almost full utilization, as marked by mills.

-- Coming to Delhi & Gujarat (North & Western India), which are known as major consumer of finished products, the trade inquiries were less than the average as per sources. Hence there was no any major change in price range despite hike in prices across regions.

-- The trade reference rebar prices of 12mm assessed at INR 30,900-31,100/MT ex-Raipur, INR 31,900-32,100/MT ex-Durgapur, INR 31,800-32,000/MT ex-Jalna, INR 31,300-31,500/MT ex-Hyderabad & INR 32,800-33,000/MT FoR Delhi; through the medium scale mills.

STRUCTURAL STEEL

The demand has not picked in comparison to rebars. However as the billet prices moved up, the producers have followed suit. On an average the prices increased by INR 100-700/MT with major hike of INR 500-700/MT in Durgapur, Ghaziabad & Hyderabd.

The average trade discounts in heavy structures in Raipur observed at INR 1,500-1,800/MT and base prices of heavy structure (200 Angle) stood at INR 35,800/MT as against last week at INR 35,500/MT ex-plant.

WIRE ROD

Raipur & Durgapur are the major wire rod producers in India in terms of medium scale mills. The mills in Raipur has kept their offers strong and have lowered discounts. On an average earlier the stockiest were offered trade discounts near to INR 1,500/MT and by mills around INR 1,000/MT which is reduced in current week to INR 800-900/MT through the mills & stockiest end due to tightened offers & supply as well.

Further in Durgapur, strong demand were reported and mills sharply raised there prices by around INR 800-1,000/MT in a week. Demand was majorly from the local buyers as well neighbouring states. Inquiries in export were average.

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project