SE Asia: Imported Scrap Prices Fall Amid Global Price Drop

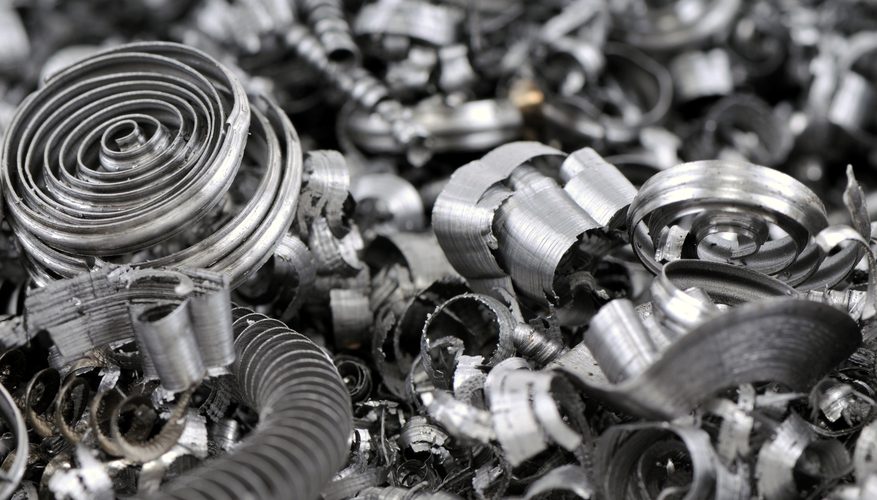

Indonesia: Indonesia imported scrap prices showed a sharp decline this week, in line with the fall in global offers. Buyer’s bids for P&S scrap of UK & European origin stood at USD 280/MT CFR Jakarta with some deals being concluded at these prices, mainly from UK based suppliers. Busheling scrap from Europe also witnessed decent bookings at lowered prices, with an East Jawa based Steelmaker booking Polish origin material around USD 295/MT CFR Vietnam, while few others mills in the region also targeted these price levels. The prices have come down sharply by around USD 25-30/MT in the last 2 weeks.

Shredded scrap from North America and Europe too observed steep downtrend, with current offers of USA & UK origin, containerized Shredded 211 standing at USD 270/MT, CFR Indonesia while HMS 1&2 (80:20) was being offered at around USD 260-263/MT, CFR.

Vietnam: Vietnamese market remained quite weak, with both buyers and sellers showing caution amid ongoing downtrend. Limited buying activity was witnessed even as prices have dropped by over USD 20/MT in recent weeks.

Japanese H2 scrap is being offered at USD 278-280/MT CFR Vietnam, while offers for higher quality HS scrap stand at around USD 310-315/MT CFR. Sharp fall in Japanese domestic scrap prices also reflected in its export offers dropping this week.

HMS 1&2 (80;20) in containers from the USA is being traded USD 260-265/MT CFR, while few offers for bulk HMS 1&2 (50:50) from Hong Kong were reported at USD 275/MT, CFR Vietnam. Many Vietnamese steelmakers have sufficient inventories available on account of large bookings earlier in Aug’19, and are thus waiting for more stability in the market with no immediate restocking necessitates.

Thailand: No recent deals for imported scrap were reported. US-origin HMS 1&2 (80:20) being reported in the range of USD 260-265/MT CFR Thailand, while Billets from India are being offered at around USD 410/MT CFR.

Codelco seeks restart at Chilean copper mine after collapse

Hudbay snags $600M investment for Arizona copper project

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling