Indian Steel Market Weekly Snapshot

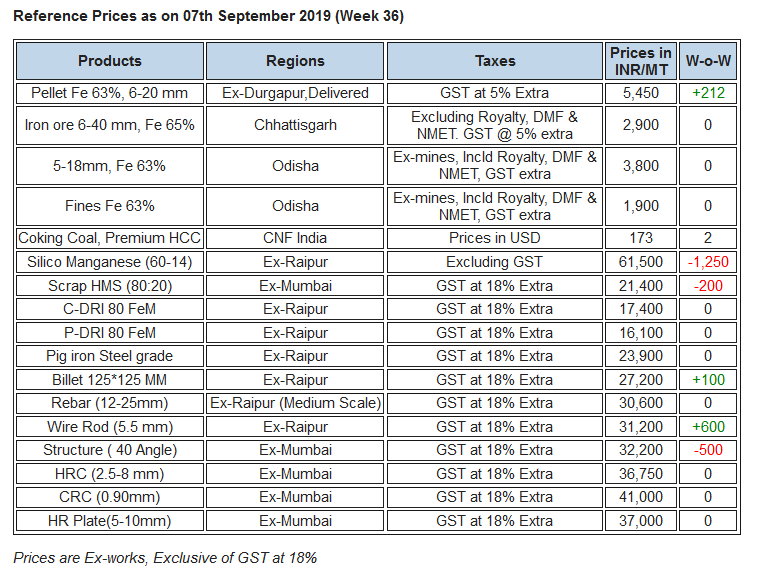

As per SteelMint's assessment, this week prices of Semis & Finished long steel products gain by INR 100-500/MT(upto USD 7). However, the Flat steel prices remained down trend and plunged about INR 500/MT (USD 7) during the week due to limited trade activities.

IRON ORE and PELLETS

Odisha merchant miners kept the iron ore prices unchanged for the week. Although market participants assuming that, the prices may revise soon. Indian government has issued a list of new royalty rates for mining leases being allotted through auction route. Odisha Mining Corporation has scheduled its next iron ore fines e-auction on 12th Sep'19, in which base prices decreased upto INR 350/MT.

PELLEX remains stable at INR 6,050/WMT (DAP Raipur) amid few trades reported for small quantity. South India (Karnataka) based - NMDC Donimalai pellet plant has kept offers unchanged at INR 6,000/MT in line with last offers (FoT basis). Raipur based plants' have kept their offers unchanged at INR 6,000/MT(Ex-plant). Jindal SAW has increased pellet (Fe 63%) offers by INR 300/MT for the week to INR 7,800/MT (delivered Kandla) as against INR 7,500/MT last week.

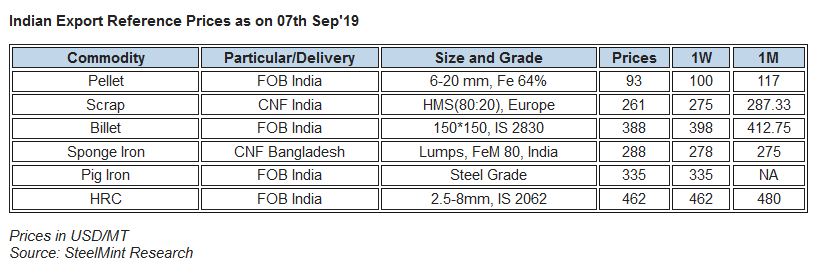

-- Pellet export deal reported from KIOCL(Karnataka) this week to China at around USD 98/MT FoB India for Fe 64% grade (Al 2%). Few deals were also heard for Malaysia and Turkey.

COAL

Australian premium low-volatile hard coking coal prices have edged down throughout the week, while the medium volatile grade prices have held steady.

In China, buying interest remained positive at the current price level, but there were no firm deals confirmed lately, as major steel mills wait to ensure full price stability before entering the market.

Meanwhile, the seaborne market for Australian coking coal appears to be potentially supported for the fourth quarter of this year — because cargoes with November-December laycan will be scheduled to arrive at the Chinese ports in the New Year, when next year’s import quotas become available.

Indian end-users are gradually resuming procurement activities of seaborne materials, with the delayed retreat of the seasonal monsoon rains in some parts of the country.

-- Latest offers for the Premium HCC grade are assessed at around USD 152.00/MT FOB Australia and USD 168.50/MT CNF India.

FERRO ALLOYS

-- Silico Manganese prices are falling aggresively in both Durgapur and Raipur. Producers believe the prices to go further down in line with tepid demand.

-- Prices of Ferro Manganese are stable despite low demand. Producers are mostly dealing with the regular demand. There may be minor deviations in the prices in the near future.

- Indian Ferro Chrome prices have gone up in line with low supply as the Chrome Ore dispatches remain affected in Jajpur, which is resulting in shutdown and production cuts of Ferro Chrome. Also with the Nickel prices going up, stainless steel prices have also increased which is also driving up the prices of Ferro Chrome.

-- Ferro Silicon producers have maintained the prices in Bhutan and it decreased in Guwahati inline with tepid demand.

FERROUS SCRAP

Indian imported scrap market saw a considerable rise in buyer's inquiries in the latter half of the week, as sharp fall in offers has increased the viability of imported scrap, after several weeks of silence. Decent deals were reported in the last few days at significantly lowered prices, while the market’s outlook has turned somewhat positive in terms of demand.

-- SteelMint's assessment for containerized Shredded from the UK , USA and Europe stands at USD 275/MT, CFR Nhava Sheva, down by over USD 15/MT against last week.

-- HMS offers too dropped considerably, with Dubai origin HMS 1 currently being offered in the range of USD 260-265/MT CFR Nhava Sheva as per quality while the UK and European origin HMS was traded at around USD 255/MT CFR. Higher quality HMS from South Africa was assessed in the range of USD 265-270/MT CFR.

SEMI FINISHED

Indian semis prices marked uptick with improved spot trades. The producers in major locations reported limited stock, hence with the better demand, there were significant surge in price range.

As per assessment, this week billet prices rose by INR 100-500/MT, while sponge iron by INR 100-300/MT in major markets.

-- The fresh export deals for Indian sponge iron (79-80 FeM, 95-100% lumps) to Bangladesh reported at near to USD 270-275/MT CPT Benapole(dry port of India & Bangladesh), this is equivalent to USD 285-290/MT CFR Chittagong.

-- India's mid sized mills export offers to Nepal is hovering at USD 370-375/MT for Billet & USD 425/MT for Wire rod, ex-mill, Durgapur.

-- As per market sources report, India's large mill export tender of near to 11,000 MT Billets & 11,000 MT Wire Rod to Nepal received highest bid for Billet at around USD 345-350/MT & for Wire rod at near to USD 420-425/MT ex-mill. However tender under negotiation mode, as stated by participants.

-- TATA Metaliks - largest Foundry grade pig iron manufacturer in eastern India has kept its pig iron offers unaltered for Sep deliveries. The offers stood for Foundry pig iron at INR 29,600/MT (USD 412) & Low Silicon (1-1.5%) pig iron is around INR 26,000/MT (USD 362); ex-Kharagpur, eastern India.

FINISH LONG

Finish long steel market in India observed better response as medium and small scale mills rebar prices slightly improved by INR 200-400/MT in central , east & northern regions of country.

However in west & southern India rebar price range seen contraction by INR 100-400/MT due to poor lifting by trade participants on heavy rain and festive mood specifically in Maharashtra.

As per SteelMint's conversation with market participants, rebar prices likely to remain range bound and might get minor reduction.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 31,500-31,700/MT Ex-Jalna & INR 30,300-30,600 Ex-Raipur.

-- Central region, Raipur based heavy structure manufacturers have increased trade discounts in this week and hovering around INR 1,400-1,800/MT; current trade reference prices at INR 35,200-35,500/MT (200 Angle), ex-work.

-- Trade discounts in Raipur Wire rod currently hovering at INR 800-1,000/MT and fresh offers stood at INR 31,000-31,500/MT ex-Durgapur & INR 31,000-31,200/MT ex-Raipur, size 5.5 mm.

In line Indian large scale mills have rolled over rebar prices for Sep'19 deliveries despite weak buying interest, which is being observed through the trade associates along with sufficient stock with mills.

-- The fresh offers for 12 mm rebar by large mills stood at around INR 33,000-33,500/MT ex-work, Jharkhand & around INR 35,000/MT ex-works, Mumbai - western India, excluding 18% GST & size 12mm.

FINISH FLAT

Indian major steel manufacturers have kept HRC, CRC prices unchanged for the month of Sep’19 owing to prolonged weakness in demand & increasing inventories in domestic market. Along with this, Indian steel mills have announced rebates and discounts to stimulate buying in domestic market.

As per sources, JSW Steel is offering HRC (2.5-8mm,IS2062) at around INR 36,750/MT (ex-Mumbai). Meanwhile another major steelmaker Essar steel is offering HRC at around INR 37,000/MT ex-Mumbai.

However few trade sources shared that Indian steel mills are also offering rebates of around INR 750-1,000/MT in order to improve buying in domestic market. Thus effective prices of HRC in trade market after discounts is hovering around INR 36,000-36,500/MT ex-Mumbai, INR 36,500/MT ex-Delhi & INR 37,000-39,000/MT ex-Chennai.

-- Domestic CRC (IS513 GR O) prices in trade market is assessed at around INR 40,500-41,500/MT ex-Mumbai, INR 40,000-41,800/MT ex-Delhi & INR 41,500-44,500/MT ex-Chennai. The all prices mentioned above are basic and excluding of 18% GST.

Significant drop in auto sales, slump in consumer spending and slowdown in construction activities over ongoing monsoon season began impacting demand in the country which in turn resulted to suppressed prices in domestic market.

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project