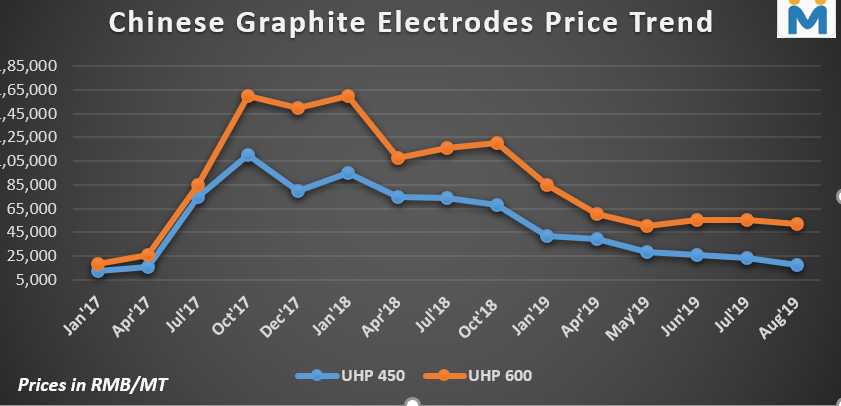

Large-Sized UHP Grade Electrodes Prices in China continue to remain Firm

As per the market sources, the market for large sized UHP grade GE of size 600-700mm is relatively active with high export orders keeping its prices stable. On the other hand, in case of ordinary power and high power grade electrodes, prices continue to fall.

However, an important piece of information that SteelMint has heard is that the inventory of non-UHP grade GE that was piled up with the manufacturers over past few months and have resulted in acute demand-supply imbalance have been sold off due to its steady consumption and production restrictions by the electrodes manufacturers. Apart from this, the GE plants that were undergoing capacity additions are almost done with their expansion work and are expected to put into operations by the end of the ongoing year.

The prices of UHP grade electrodes of size 450mm are heard to be in the range of RMB 13,000 – 17,000/MT and that of 600mm are in the range of RMB 44,000 – 60,000/MT. In terms of needle coke, the domestic needle coke market price remained stable and are heard to be around RMB 18,000 – 22,000/MT.

In the near term, the outlook for ordinary-power and high power grade electrodes remains weak and as the downstream demand remains subdued, the market consumption of the same is anticipated to remain low. With the release of new GE capacities, any support for prices is unlikely in the subsequent period. The ultra-high power grade electrodes market is relatively active, and the transaction situation is relatively good. The overall market sentiments are not affected and the transaction prices are expected to remain stable.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

China limits supply of critical minerals to US defense sector: WSJ

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift