Indian Steel Market Weekly Snapshot

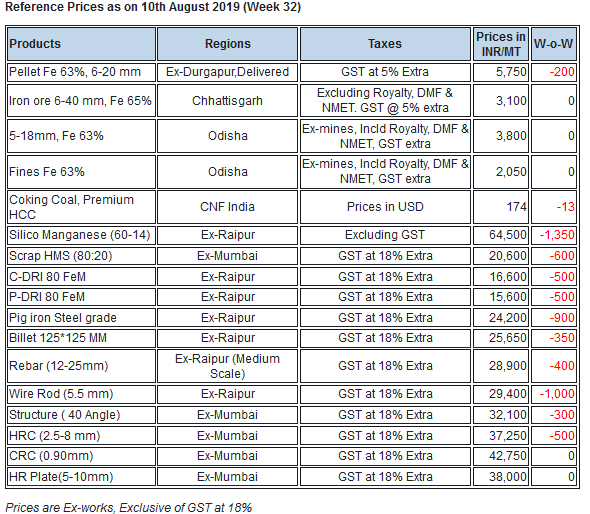

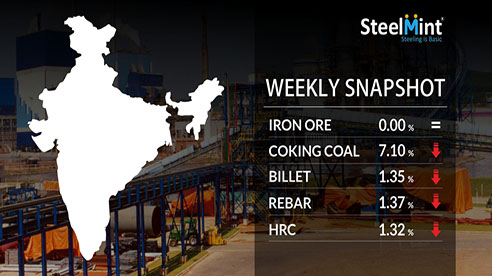

As per SteelMint assessment, this week prices of Semi Finished & Finished long steel products have declined by INR 200-1,000/MT (USD 3-14). Similarly the Flat steel prices plunged by around INR 500/MT (USD 7).

IRON ORE & PELLETS

SteelMint's assessment for 5-18 mm (Fe 63%) stands at INR 3,700-3,900/MT (ex-mines) east India. Few traders in Odisha shared that bookings have remained slow. Amid steep decline sponge prices, market participants are eyeing for further price correction. NMDC’s dispatches from Chhattisgarh continue to remain impacted amid monsoons.

Odisha Mining Corporation (OMC) had scheduled an auction for sub-grade iron ore fines on 05th Aug'19. Total quantity (525,000 MT) put under the auction was sold. Bids moved up by around INR 100-150/MT over the set base price of INR 750/MT (including Royalty). Bids received were at INR 850-900/MT.

-- Raipur (central India) based pellet manufacturers had decreased their offers by INR 600/MT W-o-W to INR 6,200/MT ex-plant.

-- In Durgapur SteelMint’s reference, pellet price assessment stands at INR 5,700-5,800 (delivered) down against the last assessment at INR 5,800-5,900/MT beginning of this week.

-- West India (Rajasthan) based pellet maker - Jindal SAW cut pellet (Fe 63%) offers by INR 500/MT to INR 7,800/MT (delivered Kandla).

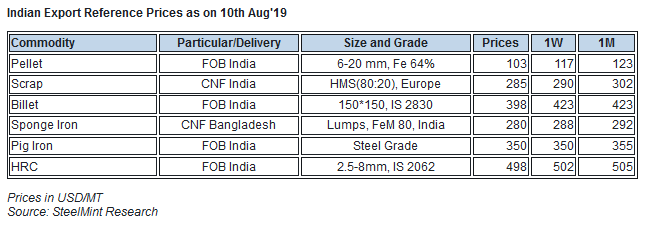

-- SteelMint's Pellet export realization for standard grade pellet has come down to USD 100-105/MT FoB (Al 3%); due to sluggish buying in China. No export deals for pellet reported this week.

COAL

Australian premium low-volatile hard coking coal prices have seen a slight recovery in this week amid signs of market stabilisation, although the medium volatile hard coking coal prices have continued to fall straight down.

China-delivered prices have also moved lower throughout the week, notwithstanding new bids floated in the Chinese market.

Indian sellers anticipate seeing conclusion of trades in the coming week, as a modest return of some buying interest has been observed lately — possibly due to competitive seaborne prices. Latest offers for the Premium HCC grade are assessed at around USD 160.00/MT FOB Australia and USD 173.70/MT CNF India.

SCRAP

Indian imported scrap prices plunged to almost 2 years low levels as overall market sentiments remained bearish. Importers turn totally silent amid weakened scrap demand globally on Eid holidays while forestalling chances of a recession on its way looking at dwindling auto sales and weakened construction industry in India. Many traders look to clear high seas scrap cargoes as buyers stepped back from their orders amid successively fallen domestic steel prices amid ongoing monsoon production cuts and limited cash flow.

-- As per assessment offers for containerised Shredded from UK, Europe and USA stands at USD 300-310/MT, CFR Nhava Sheva, further down USD 5-10/MT against the last week. Offers of HMS 1 from Dubai remained limited in the range of USD 275-285/MT, CFR Nhava Sheva while South African HMS 1 was being offered at around USD 290/MT, CFR. West African HMS scrap assessed at around USD 270-280/MT, CFR India.

-- As per our last assessment the Ship breaking offers declined by USD 20/MT W-o-W due to cautious buying by Indian indenters as Rupee dropped by 1-2% in recent and currently trading at INR 70.73 against US dollar. The fresh offers to imports in India stood at USD 360/LT for Tankers, USD 370/LT for Containers & USD 350/LT for Dry bulk on CNF basis.

FERRO ALLOYS

-- Silico Manganese prices fell in Durgapur and Raipur owing to low demand and sluggish steel market; producers are offering at INR 64,500/MT for both ex-Durgapur and ex-Raipur.

-- Ferro Manganese demand remains low and the market is still affected by imports from Malaysia and South Africa. Major producers are keener towards supplying in the international market rather than the domestic market. Ferro Manganese prices are at INR 68,000/MT ex-Raipur. In Durgapur, offers are at a range of INR 67,000 - 68,000/MT ex-Durgapur.

-- Overall offer prices of Ferro Chrome had increased in line with international prices of Ferro Chrome owing to higher Nickel prices and recent currency depreciation. Domestic Prices for Ferro Chrome in India is assessed in the range of INR 63,000-64,000/MT.

-- Ferro Silicon prices in India fell on persistent low demand in line with a lacklustre Stainless Steel market in India. Producers from Bhutan are offering Ferro Silicon at INR 66,000/MT ex-Bhutan and prices in Guwahati is at around INR 67,000/MT.

SEMI FINISHED

Indian domestic Billet offers slashed by INR 200-800/MT (USD 3-11) across the country on account of mis-match trade cycle amid slower demand in domestic & exports as well.

Inline, Sponge iron prices declined by INR 200-600/MT across regions following drop in Billet prices with curtailing furnaces productions and selling pressure among producers.

-- Indian sponge iron export offers for FeM 79-80 grade lumps, recorded at USD 255-260/MT CPT Benapole (dry land port of Bangladesh & India) and USD 275/MT CNF Chittagong, Bangladesh, the offers fell by around USD 10/MT W-o-W.

-- Mid sized mills export offers to Nepal drop further and stood at around USD 350/MT for Billet (100*100 mm) & USD 410/MT for Wire rod (5.5 mm) ex-mill at Durgapur, eastern India.

-- Indian recent BILLET export tender reported to have received highest bid at around USD 395-400/MT FOB, down by USD 10-15/MT from the previous tender which expired on 2nd Aug'19. Sources believed that, the Company likely to cancel the tender on low participation.

-- Private pig iron producers have decreased prices by INR 500-1,000/MT, W-o-W. Latest offers for steel grade is hovering at INR 24,100-24,200/MT in Raipur, INR 23,400-23,800/MT ex-Durgapur & INR 23,300-23,500/MT ex-Bokaro (Jharkhand).

-- Vizag Steel has issued an export tender of 25,000 MT basic grade steel making Pig iron for any country other than Nepal. This tender is due on 14 Aug’19.

-- RINL has invited a tender for export of 10,000 MT Wire Rod, 20,000 MT Bloom, 10,000 MT Cast Round and 20,000 MT Billets. Interested bidders can submit their bids till 13 Aug’19 at 14:00.

-- SAIL has reduced basic grade (steel grade) pig iron offers by around INR 700/MT (USD 10) to INR 23,800/MT (USD 337) from its Bhilai Steel Plant (BSP) based in Central India- Sources.

-- Jindal Steel has further lowered pig iron offers and reported steel grade at around INR 24,200/MT ex-Raigarh.

FINISH LONG

Indian Finish Long steel market observed subdued demand or seems getting limited response from associates i.e. traders/re-sellers end as rebar price range has been narrowed down by INR 500-1,000/MT (USD 7-14) across regions during the week.

However from yesterday few specified locations registered slight rise in price range on strengthening raw materials (Billet) prices.

Meanwhile SteelMint learned that, the rebar prices likely to remain under pressure as trade volumes not upto the mark in major locations amid sufficient stock with the small/mid sized rolling mills.

In addition it also analysed that, rebar offers of state owned large mills are considerable high in comparison to offers through the renowned brands in secondary market considering supply in retail & project works.

-- Central region, Raipur based heavy structure manufacturers have reduced trade discount by INR 200-300/MT to INR 1,100-1,300/MT against last week and current trade reference prices hovering at INR 34,300-34,700/MT (200 Angle) ex-work and price range fell by INR 300-900/MT in most of the regions.

-- Trade discounts in Raipur Wire rod currently hovering at INR 1,100-1,300/MT and fresh offers stood at INR 29,300-30,000/MT ex-Durgapur & INR 29,200-29,400/MT ex-Raipur, size 5.5 mm.

-- BHEL invites tender for purchase of 80,000 MTR Pipe in Uttarakhand. The due date for submitting the bids is 29 Aug’19.

FLAT STEEL

This week Indian HRC prices witness further slump in few major markets over slow growth in demand and mute buying prevailing in domestic market. However in the beginning of the week major steel mills announced roll over in flat steel prices for August deliveries.

As per SteelMint price assessment trade reference prices for HRC (IS2062, 2.5-8 mm) is currently at INR 37,000-37,500/MT ex-Mumbai, INR 37,000-37,500/MT ex-Delhi and INR 39,000-40,000/MT ex-Chennai. Meanwhile trade reference prices of CRC (0.9 mm, IS 513) prices on weekly basis are hovering at INR 42,500-43,000/MT ex-Mumbai, INR 40,000-42,000/MT ex-Delhi and INR 43,500-44,500/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Few industry participants shared that poor sales in auto sector and absence of Govt expenditure along with ongoing monsoon season continue to keep domestic HRC prices under pressure in domestic market.

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project