South Korea Increases Radiation Checks on Japanese Scrap amid Trade Tension

Reportedly, the customs authorities are individually checking every scrap carrying vessel from Japan for radiation tests, unlike earlier when only random checks used to be conducted on scrap carrying vessels.

The direct impact of the same is likely to be reflected in the freight costs, thereby increasing the CFR price of Japanese ferrous scrap to South Korea. The said changes in inspection policy come in the aftermath of the Japan removing South Korea from customs white-list. The major ports observing an increase in inspection activity include Dangjin, Gwangyang, Busan, and Masan ports in South Korea.

With the recent increase in economic and political strains between the 2 countries, in addition to the port congestion at South Korean ports, it is expected that demand of Japanese scrap from Korea will reduce in the coming days, while an increase of bulk vessel bookings from other major sources of scrap like USA and Russia is being anticipated.

Recently, Japanese scrap exporters had increased the offers for South Korean buyers to around JPY 28,000-29,000/MT following an uptrend observed in the domestic scrap market after a gap of over 3 months. However, South Korea’s largest EAF steelmaker Hyundai Steel has not bid for Japanese scrap in over a month, since it had last revised its purchase price on 5th July’19 to JPY 27,000/MT, while the market is carefully observing the standoff between the countries.

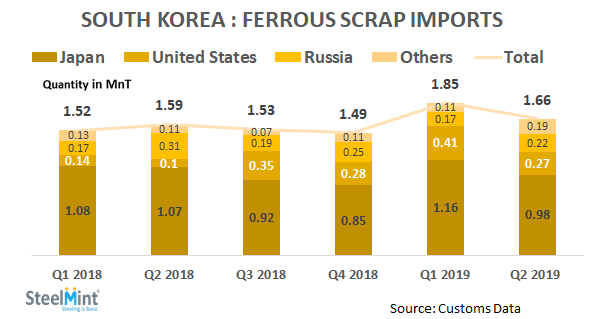

South Korea’s ferrous scrap imports decreased by 10% Q-o-Q in Q2’19 as the country imported 1.66 MnT in the quarter as against 1.85 MnT in Q1’19. Notably, Japan’s share in total imports by South Korea dropped from 63% in Q1’19 to 59% in Q2’19, while Russia’s share increased from 9% in Q1’19 to 13% in Q2’19.

~Inputs from Steel Dailya

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge