Production Curtailment by Furnaces Weigh Down Indian Sponge Iron Prices

Industry participants reported, prices are falling continuously on account of poor demand from local electric arc furnaces or induction furnaces due to curtailed productions & fall in substitute product prices amid lower sales of finished steel.

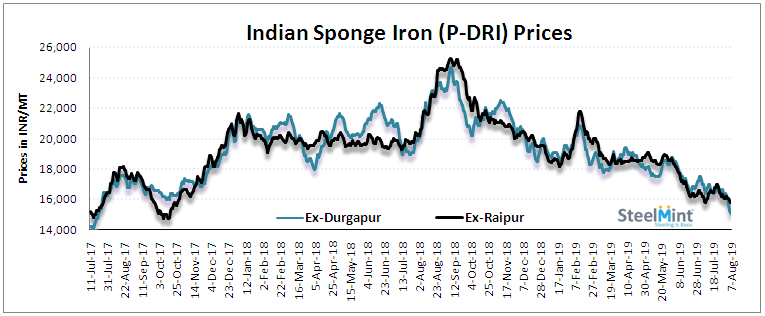

As per assessment, latest offers for Sponge P-DRI is about INR 15,700-15,900/MT ex-Raipur, INR 14,700-14,900/MT in Durgapur and INR 15,600-15,800/MT ex-Bellary for 78-80 FeM grade.

On weekly basis, the major fall was seen in Durgapur, east India by INR 1,600/MT (USD 23). As per trade participants, “No major inter & intra state trades were noticed over falling ingot/billet production due to shuttering mills & increased supply led to free-fall in prices.”

Also sponge manufacturer in central India stated, “Falling prices of raw materials like iron ore/pellets amid competitive offers from outside suppliers, leads to price competitiveness/corrections among local suppliers.”

Few deals of Sponge (P-DRI) reported at INR 15,700-15,800/MT FoR Raipur. However offers through the local suppliers hovering at INR 15,800-15,900/MT ex-plant, which landed cost reported at INR 16,000/MT.

Further, the participants from eastern region - Odisha reported, very limited buying at the prevailing offers of INR 15,800-16,000/MT (ex-plant) for FeM 80 C-DRI mix material. Further if sources are to be believed, few deals of FeM 80 C-DRI mix material at near to INR 16,200-16,300/MT FoR Raigarh, which is quite competitive than prevailing offers in general market.

Additionally, the current sponge prices in east India have declined to 2 years low as similar offers was recorded during July-Aug'17.

Further in Bellary few small size sponge producers (100-300 TPD) stated that there is less demand from West (Maharashtra & Gujarat) as well from domestic market. BMM Ispat, a price trend setter in southern India has lowered offers by INR 200/MT to INR 15,700-15,800/MT ex-Bellary, as per officials.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge