Will Indian Billet Offers Fall Further ?

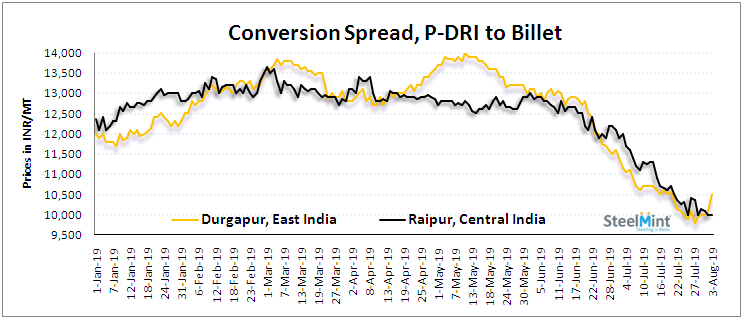

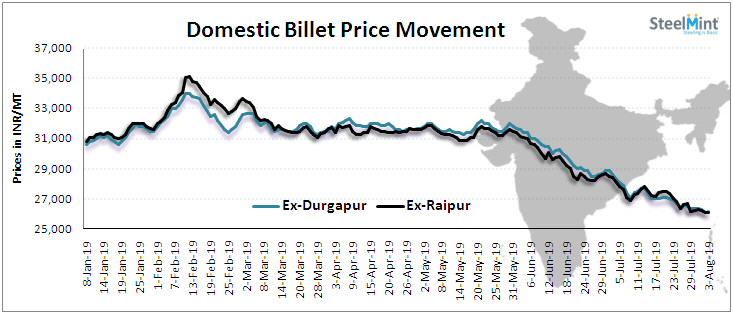

Meanwhile as the margins (conversion spread) are on bottom line, the industry experts believe that there is less scope for further drop in ingot/billet prices along with expected stability in raw materials like sponge iron, pig iron & scrap.

SteelMint learned that in major locations the secondary manufacturers are facing liquidity crunch over limited sales amid low conversion. Thus they are forced to reduce production to maintain balance between demand-supply.

According to participants in Raigarh, “most of the medium sized furnaces have cut down their operation and are running units for 12 hrs (50%) instead of 24 hrs in a day.”

Similar conditions were reported in Raipur, West Bengal, Odisha, Jharkhand & Maharashtra (Central, East & Western India). These plants include standalone Induction furnaces, rolling mills & hot rolling mills.

Another source in central India reported, “As of now 50% production cuts continued, although few manufacturers are running their mills that have raw material stocks. While others who are out of stock are in a wait & watch mode to buy raw materials”.

Further in eastern India, Odisha based 100-300 TPD sponge manufacturer reported that most of Ingot/billet manufacturers have temporarily halted operations which do not have any stock of raw materials i.e. sponge iron.

Moreover similar comments were received from sponge manufacturers in Jharkhand whose sales were hampered over the closure of furnaces in the region.

As per sources, in Jharkhand about 25-30 steel plants have downed their shutters after state government exorbitantly hiked power tariff by 38% with effect from Apr'19.

Hence the producers don't have other option than to close down operations as their production cost has spiraled, SteelMint learned in conversation with industry participants.

First Quantum scores $1B streaming deal with Royal Gold

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times