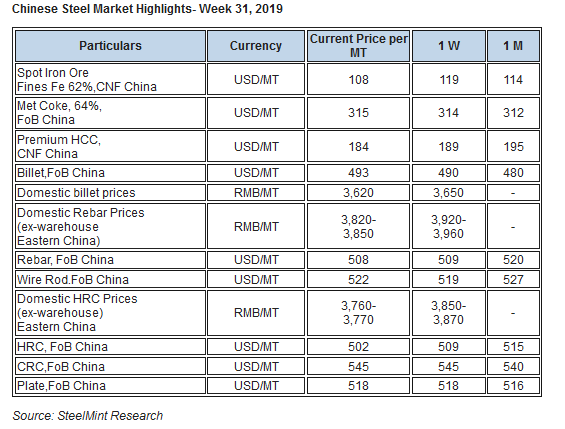

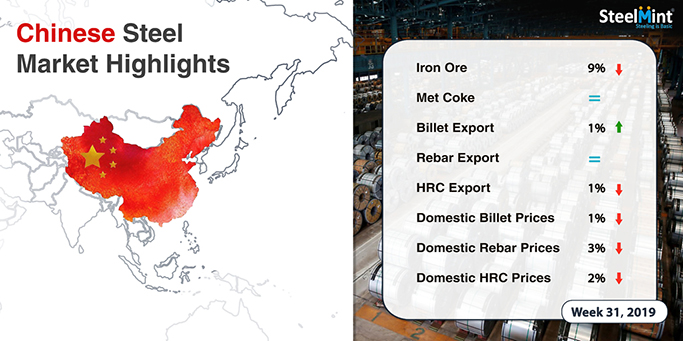

Chinese Steel Market Highlights- Week 31, 2019

Limited demand & increased port stocks pull down Chinese spot iron ore prices- Chinese spot iron ore prices opened up this week at USD 118.45/MT, dropped to USD 108.45/MT towards weekend amid easing supply concerns. The miner on 23rd July’19 announced authority received from National Mining Agency (ANM) for partial resumption of dry processing at Vargem Grande Complex, which is expected to add 5 MnT of production in 2019.

As per data compiled by SteelHome consultancy, iron ore inventory at major Chinese ports increased to 121.05 MnT as compared to 119.25 MnT a week ago.

Spot pellet premium up marginally- Spot pellet premium for Fe 65% grade pellets assessed at USD 23.75/MT, CFR China as against USD 23.70/MT, CFR China a week before. Pellet inventory at major Chinese ports witnessed at 5.1 MnT up on weekly basis compared to 5 MnT last week.

Spot lump premium fell on weekly basis- This week spot lump premium prices witnessed fall to USD 0.1800/DMTU as against USD 0.2050/DMTU assessed last week. The fall in lump premium may accelerate lump demand in the Chinese markets. However, preference for pellet over lumps continues to be dominant in Chinese market.

Coking coal offers plunge- Seaborne hard coking coal prices have continued to decline throughout the week, as producers kept lowering offer levels in light of persistent weakness in the Asia-Pacific markets.

The Chinese market in order to take advantage of competitive pricing considered restocking albeit at lower levels as concerns on customs restrictions in China still persists.

Even though the seaborne prices are lucrative, end-users in India keep a wait and watch approach in anticipation of further fall in prices in August while they hold stocks to last till the end of monsoon season.

Latest offers for the Premium HCC grade are assessed at around USD 160.25/MT FOB Australia which was 171.75/MT FoB Australia in preceding week.

China domestic billet witness drop by RMB 30- This week Chinese domestic billet prices in Tangshan rolled back by RMB 30/MT amid Tangshan Ecology and Environment Bureau asking municipal government to issue the “Intensified Management and Control Plan for Air Pollution Prevention and Control in the City in August”, which will limit the production of the steel industry up to 50%, and take effect from August 1 to August 31.

At present Chinese domestic billet prices in Tangshan have settled at RMB 3,620/MT, down by RMB 30/MT against RMB 3,650/MT in previous week. This week, billet trade sentiments in China were reported weak.

Chinese HRC export offers- This week Chinese HRC exports offers declined by USD 7/MT with volatile futures and higher inventories amid bearish market sentiments in both domestic and overseas market. Meanwhile China based exporters are facing competition from exporters based in other regions.

Currently nation’s HRC export offers stood at USD 500-504/MT as against 507-510/MT FoB in previous week.

On weekly basis domestic HRC prices in China stood at RMB 3,760-3,770/MT in eastern China (Shanghai) plunged by RMB 90-100/MT which was RMB 3,850-3,870/MT in eastern China (Shanghai) in previous week.

Sentiments in the future market further dampened with US proposing 10% tariff on USD 300 billion of Chinese imports effective from Sep’19 on top of previous tariffs on USD 250 billion. Meanwhile higher inventories amid lenient production curb announcement and weaker demand in both domestic and overseas market may keep Chinese HRC prices under pressure.

Chinese rebar export offers remain largely stable on weekly basis- This week nation’s rebar export offers remained largely stable amid subdued demand with overseas importers preferring materials from other regions over cost effectiveness. Though moderate domestic demand during the start of week provided some gains in domestic market.

On an average basis currently nation’s rebar export offers stood at USD 505-510/MT FoB China which was around USD 509/MT FoB basis last week.

Meanwhile domestic rebar prices stood at RMB 3,820-3,850/MT (Eastern China) declined significantly against RMB 3,960-3,990/MT (Eastern China) in last week.

Prevailing unpleasant weather conditions to enter into peak period in the country led to fall in demand from construction sector which resulted to higher inventory levels while the market sentiments remained bearish amid announcement of fresh 10% tariffs by US on USD 300 billion of Chinese imports.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge