Indian Steel Market Weekly Snapshot

The domestic buyers were cautious to take positions on assumptions of further decline in price range. However sellers are working below Par Value which in turn closure of few mills over limited margins.

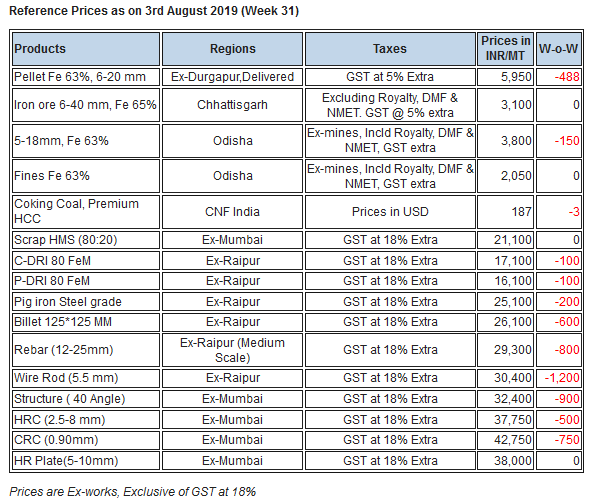

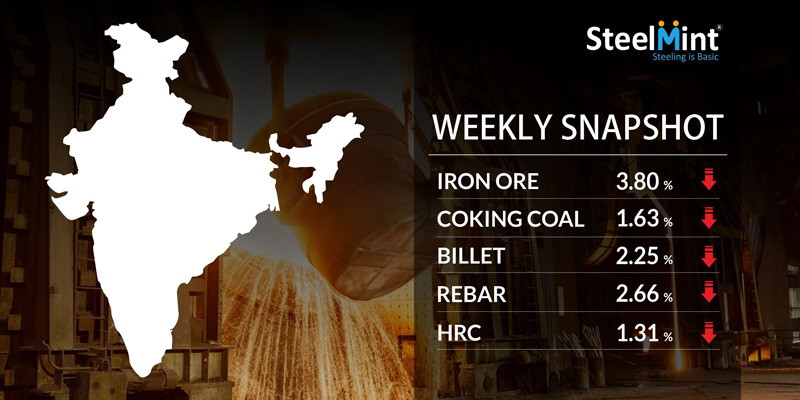

As per SteelMint's assessment, in these days the prices of Semis products (Billet & Sponge iron) have declined by INR 200-1,000/MT (USD 3-14) & Finished long steel upto INR 500-1,200/MT. Inline, Finished flat steel prices declined by INR 500-1,000/MT, W-o-W.

IRON ORE & PELLETS

Odisha's major merchant miner Serajuddin has decreased iron ore lump 5-18 mm (Fe 63%) offers on 02 Aug’19 by INR 300/MT to INR 3,700/MT (ex-mines, including Royalty, DMF, & NMET). Other miners prices revision expected to be announced soon. Odisha Mining Corporation (OMC) had scheduled its iron ore lump e-auction 02 Aug’19 and nearly 60% (275,000 MT) of material booked at base price.

Durgapur pellet offers fall amid declining P-DRI prices SteelMint’s reference, pellet price assessment stands at INR 5,900-6,000 (delivered) down sharply by INR 300-400/MT against INR 6,300-6,400/MT end of the last week assessment. Raipur (Central India) based pellet manufacturers kept the pellet offers remains unchanged at INR 6,800/MT (ex-Raipur, GST extra). Southern India (Bellary) based pellet makers have witnessed at INR 6,100-6,300/MT in line with last week assessment.

Central India based sponge makers booked pellets from Odisha on cost competitiveness however towards the end of the week, there were no firm offers heard from Odisha over export booking made.

-- A Pellet export deal of 55,000 MT reported at USD 128-129/MT CFR China (down by USD 2-3/MT), equivalent to USD 114-115/MT FOB India. Most of the manufacturers hold their offers at USD 131-132/MT CFR China.

-- State-owned, KIOCL has invited a tender for purchase of 70,000 DMT iron ore from overseas/off-shore sources for use in the pellet plant. Interested bidders can submit their bids till 09 Aug’19 at 14:00 hrs.

-- Deb Kalyan Mohanty assumed charge as the new Director (Commercial) at RINL-VSP on August 1, 2019.

COAL

Australian coking coal prices have continued to plunge throughout the week, as producers kept lowering offer levels in light of persistent weakness in the Asia-Pacific markets, coupled with growing concerns on customs restrictions in China.

The Chinese market saw a flurry of fresh seaborne trades concluded, albeit at lower level, as steelmakers considered restocking in order to take advantage of competitive pricing compared to domestic coals.

However, Indian end-users stayed cautious even as the seaborne prices are certainly attractive for buying spot cargoes. Sources claim that most steel mills are well covered until the end of monsoon, and are waiting for prices to come down further and possibly hit rock bottom in August. Latest offers for the Premium HCC grade are assessed at around USD 160.25/MT FOB Australia and USD 174.65/MT CNF India.

SCRAP

Indian domestic steel market condition remained very sluggish keeping imports of scrap less viable since a couple of months now, notably, HMS scrap offers to India are standing at 1 years' low however wide disparity between buying interest and offers continue to keep trades very limited in the market. Also, production cuts by steelmakers on monsoon impacted further.

-- An assessment for containerized Shredded from UK, Europe and USA stands at USD 310-313/MT, CFR Nhava Sheva, marginally down against the last week. Offers of HMS 1 from Dubai have dropped further in the range USD 275-285/MT, CFR Nhava Sheva sharply down by USD 15/MT on W-o-W. South African HMS 1 was being offered at around USD 295-300/MT, CFR. Few deals of West African HMS scrap reported at around USD 270-280/MT, CFR. Arrival of a couple of bulk vessels filled scrap inventories in hand with West Coastal steelmakers further.

SEMI FINISHED

Indian billet trades slow-down this week as prices slump by INR 300-800/MT amid poor off take of finished steel products. In these period major fall of INR 600-800/MT in billet seen in Durgapur & Raipur.

Similarly, Sponge iron offers dropped by INR 200-1,000/MT W-o-W following significant fall in Billet prices amid sharp fall in price range, selling pressure being mounts with the sponge producers along with low margins over falling ingot/billet production of standalone mills has lowered supply in merchant market

-- Indian sponge iron export offers fell by USD 5-10/MT and stood at USD 265-270/MT CPT Benapole (dry land port of Bangladesh & India) and USD 280-285/MT CNF Chittagong, Bangladesh, for 80 FeM sponge & 100% lumps.

-- The Billet (100*100 mm) export offers by mid sized mills in Durgapur, eastern India stood at around USD 370/MT ex-mill, this is equivalent to USD 395-400/MT CFR Raxaul border, Nepal.

-- Steel grade pig iron offers stood at INR 24,300-24,700/MT ex-Durgapur, INR 24,300-24,600/MT ex-Jharkhand, INR 24,000/MT ex-Jajpur (Odisha) & INR 25,100-25,200/MT FoR Raipur/Raigarh; excluding 18% GST.

-- SAIL conducted auction for around 2,500 MT steel grade pig iron today from its Rourkela Steel plant (eastern India), had received good response as entire offered quantity was sold out at INR 24,250-24,300/MT; ex-plant, Rourkela.

-- Indian mill based in eastern region heard to have concluded a bulk parcel of 50,000 MT granulated pig iron (GPI) last week to China at around USD 340-350/MT FOB India east coast- sources.

-- Jindal Steel has slightly reduced offers and reported steel grade pig iron at INR 24,800-25,000/MT ex-Raigarh & panther shots at INR 24,000/MT ex-Angul, Odisha.

-- JSW Steel offers gas based DRI at around INR 17,500/MT ex-plant, Dolvi (Maharashtra), as per sources.

-- Rashtriya Ispat Nigam Limited has invited tender for export of 10,836 MT Billets, 5,418 MT Blooms and 8,127 MT Wire Rod to Nepal. Interested bidders can submit their bids till 5 Aug’19 at 14:00 hrs.

-- The latest offers by TATA Metaliks for Foundry pig iron is reported at INR 30,400/MT (USD 442) & Low Silicon (1-1.5%) pig iron at INR 27,200/MT (USD 395); ex-plant, Kharagpur, eastern India. The company has reduced Foundry pig iron offers by INR 600/MT (USD 9) & Low Silicon pig iron by INR 500/MT (USD 7) on 30th July.

-- SAIL has floated export tender for 18,900 MT prime mild steel non-alloy concast billets (125*125 mm) from Durgapur Steel plant. The last date for bid submission was on 02 Aug’19.

-- Ingot/Billet manufacturers in Raipur bought SAIL's (BSP) pig iron at around INR 25,200/MT FoR, through the traders in the first half of week.

FINISH LONG

Indian Finish long steel market remain depressed over lack of clarity in market direction and it’s being observed among market participants that inadequate trade volume still disturbing the conversion spread from billet to rebar as production level remained low in the major supplying regions where its being reported around 55-60% in central region and 60-70% in east region, reported by trade sources.

On weekly basis, rebar price range has been dropped by around INR 200-500/MT in most of the regions except west region (Maharashtra) where it has fallen down by around INR 700-1,100/MT, W-o-W.

Further is is learned that couple of large scale mills have reduced finish long steel prices by INR 1,000/MT (USD 14) and it’s being assumed by trade participants that the mills may provide additional discounts through internal rebate upon considerable booking quantity.

-- Central region, Raipur based heavy structure manufacturers have stretched up trade discount by INR 300-400/MT to INR 1,200-1,400/MT against last week and current trade reference prices at INR 34,800-35,200/MT (200 Angle) ex-work and the price level declined by INR 400-800/MT in most of the regions.

-- Trade discounts in Raipur Wire rod reported stable in this week at INR 1,700-1,900/MT and fresh offers stood at INR 29,800-30,000/MT ex-Durgapur & INR 29,800-30,400/MT ex-Raipur, size 5.5 mm.

FLAT STEEL

Indian HRC prices continued to remain on lower side this week over tedious demand and dull buying prevailing in domestic market. Trade sources shared that market sentiments continued to remain lacklustre over fewer trades happening in domestic market.

As per SteelMint price assessment trade reference prices for HRC (IS2062, 2.5-8 mm) is currently at INR 37,500-38,000/MT ex-Mumbai, INR 37,000-37,500/MT ex-Delhi and INR 39,000-40,000/MT ex-Chennai. The trade reference prices of CRC (0.9 mm, IS 513) prices on weekly basis are hovering at around INR 42,500-43,000/MT ex-Mumbai, INR 40,500-42,500/MT ex-Delhi and INR 43,500-44,500/MT ex-Chennai. Prices mentioned above are basic and extra GST@ 18% will be applicable.

Price announcement of major steel mills is expected to be made shortly.

First Quantum scores $1B streaming deal with Royal Gold

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times