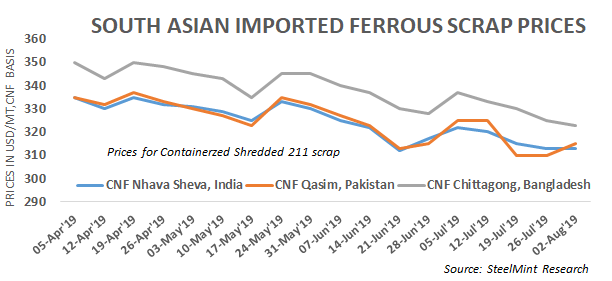

South Asia: Imported Scrap Prices Under Pressure on Weak Demand

Indian market remained totally silent on the impact of local issues like limited case flow, successively falling steel and semi-finish steel prices and heavy rains in the country. On the other few steelmakers extended their production cuts and few also took maintenance shutdown. The disparity between buyers’ bids and offer levels from suppliers remain wide (around USD 15-20/MT) keeping trades very less in numbers.

SteelMint’s assessment for containerized Shredded from UK, Europe and USA stands at USD 310-313/MT, CFR Nhava Sheva, narrowing down further by USD 3-5/MT against last week’s report. Recent jump in domestic scrap prices in the domestic market of US and Europe kept leading recyclers away from offering much as they still expect USD 318-320/MT, CFR levels for fresh deals.

“After witnessing limited trades of Shredded scrap at USD 307-309/MT, CFR Qasim, now traders are offering mostly in the range of USD 312-315/MT, CFR on recent jump in domestic scrap prices in US" shared a source. Nearly 4,500 MT Shredded scrap was sold at USD 313-318/MT, CFR Port Qasim this week.

No buyers were seen interested for bulk scrap bookings amid poor buying interest. While recent arrival of a couple of bulk cargoes at Kandla port fill scrap inventories with Gujarat based steelmakers further.

HMS scrap prices came under pressure - Offers of HMS 1 scrap from Dubai have moved down in the range USD 275-285/MT, CFR Nhava Sheva while HMS 1&2 scrap offers were being reported at USD 270-275/MT depending on quality amid saturation from both sellers and buyers end.

South African origin HMS 1 was assessed at around USD 295-300/MT, CFR Nhava Sheva and USD 300/MT, CFR Qasim. Few trades of West African HMS 1&2 (80:20) reported around USD 275-280/MT, CFR Goa, depending upon quality and container size varying from 20-24 MT loading. Buyers were remained interested mostly in the range USD 265-270/MT, CFR in which UK based sheared HMS was only being offered.

Indian domestic scrap prices rangebound - Over the last 1 month, domestic scrap & semi finish prices have moved down by INR 1,500-2,000/MT (USD 22-29) while with several steelmakers undergoing production cuts domestic scrap prices likely to remain under pressure, thus, keeping imported scrap less viable. Indian Rupee has depreciated in the second half of this week to 69.6 levels today from 68.9 levels a week earlier against USD.

The current assessment of local HMS 1&2 (80:20) stands at INR 21,000-21,200/MT (USD 301-304), CFR Mumbai. On the other hand, the price gap between domestic scrap and imported scrap remain around INR 1000-1500/MT pulling imported scrap interest further down. Chennai based HMS 1&2 (80:20) assessed at INR 20,200-20,500/MT, ex-works stable on W-o-W.

Codelco seeks restart at Chilean copper mine after collapse

Hudbay snags $600M investment for Arizona copper project

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling