Indian Rebar Demand Remains Subdued; Prices Drop

Factors which could be attribute towards diminishing sentiments are owing to less allocation of funds which are being restricted due to number of considerable bad-debt loans from different sectors and few default payments notified through known infra developers which is ultimately affecting fund movement by banking/nbfc for new housing projects.

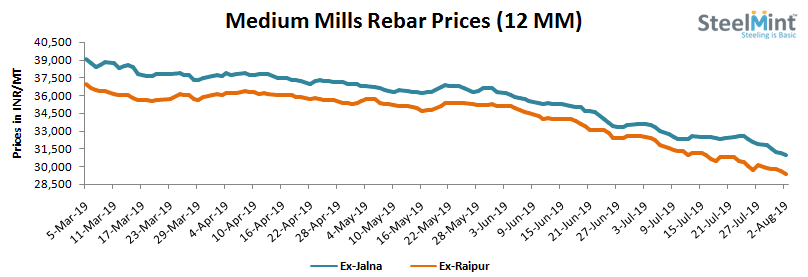

Limited procurement through retailers amid monsoon season which is weighing inventory levels at trade associates premises and resulting selling pressure where rebar price range reduced by around INR 200-500/MT in most of the regions except west region (Maharashtra) where it has fallen down by INR 700-1,100/MT on weekly basis.

Whereas, the prices fell by around INR 2,000-3,000/MT in most of the regions except south region which is narrowed down by INR 700-1,200/MT in Chennai & Hyderabad as per monthly assessment.

Further, central region based few rolling mills are running their production level around 55-60% which remain stable against last week assessment and east region based rolling mills production hovering at 60-70%, as per trade sources.

Market participants assuming that rebar prices range should remain slightly volatile and no major changes are expected to be seen in near short term but large scale mills price reduction announcement will have its own impact and could vary upon region.

In context to conversion spread from billet to rebar on day basis is hovering around INR 3,100-300/MT ex- Raipur, INR 3,700-3,900/MT ex-Raigarh, INR 2,800-3,000/MT ex-Mumbai, INR 3,500/MT, INR 4,200- 4,400/MT ex Chennai & INR 4,000-4,200/MT Ex Durgapur.

Trade Updates (Rebar - 12 mm)

-- Rathi Steels based in North region is current offering around INR 34,500/MT (ex-Delhi).

-- Raipur based - Prime Ispat Ltd. (Tecon TMT) is offering at INR 29,700/MT (down by INR 300/MT).

-- Real Ispat (GK TMT) is offering at INR 32,200/MT (down by INR 300/MT).

-- Raigarh based Anjani Steels Ltd. (Radhe TMT) is offering at INR 29,800/MT (down by INR 200/MT).

-- Raigarh based Scan Group branding (Shrishti TMT) is offering at INR 30,000/MT (down by INR 300/MT).

-- Gujarat based Akshar Ispat Ltd. (Akshat TMT) is current offering at INR 32,700/MT FoR.

-- Wardha based Sangam TMT has unchnaged their offering at INR 30,500/MT.

-- Jalna based Bhagyalaxmi Rolling Mill Pvt Ltd (Polaad TMT) has unchanged their offers at INR 31,300/MT.

-- Jalna based Rajuri Steel Pvt. Ltd. (Rajuri) TMT has unchanged their offers at INR 31,400/MT.

Note – Prices mentioned above are ex-work, excluding GST & changes are placed on day basis. Prices are subject to reconfirmation.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge