Pakistan: Imported Scrap Offers Inch Up; Trade Activities Slow Down

Trade activities remained comparatively slow this week after the active restocking by mills in last 2-3 weeks, with a mismatch in offers and buyers’ expectations keeping the market slow. Domestic market continued to witness low demand, amid a slight increase in finished steel prices

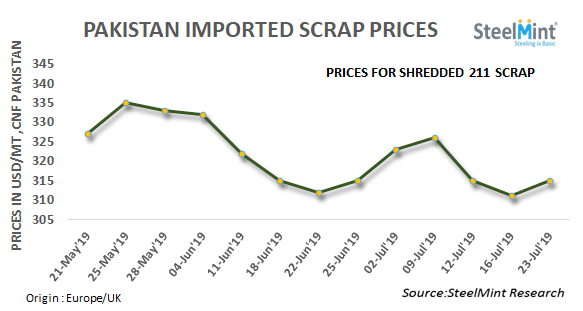

SteelMint’s assessment for containerized Shredded 211 scrap from US, Europe and UK stands at USD 315-320/MT, CFR Qasim, up by around USD 7-8/MT against last week’s report, with few deals being concluded in this range. Offers mostly remained at around USD 317-320/MT, but lower buying interest kept trades limited. Some leading recyclers withheld their offers and kept away from trading activity, on account of non-viability of the current low prices in the market.

Assessment for Dubai origin HMS stands at around USD 300-305/MT, CFR, depending on quality, with some low volume bookings being recorded this week. UK origin HMS 1&2 remained at around USD 295/MT, CFR Qasim, but the number of offers remained scarce.

Pakistani Rupee remained rangebound and stood at around 159-160 levels against USD this week.

Domestic steel market remains slow, prices inch up - Domestic market remained slow in terms of finished steel sales on low demand, in addition to which the new STRN (Sales tax Registration Number) rules by the FBR has slowed down the trades. As per new rules in the sales tax procedure, the GST applicable for the registered companies (having STRN) will be 17%, while it is 20% for non registered companies (without STRN), thus creating confusion among the end users.

The recently imposed 17% FED on the FATA-PATA based steelmakers, was asked to be reconsidered by mill owners based in these regions, however it was reported that PSMA’s former Chairman Mian Iqbal Tariq has advocated for continuation of the FED imposition in tribal areas also, in order to bring all steel mills at level playing field, and urged PM Imran Khan for the same.

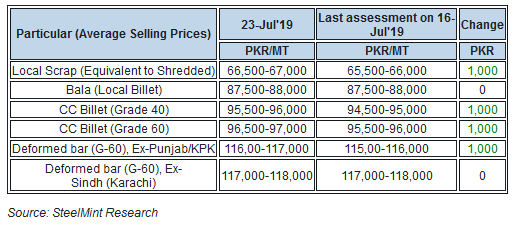

With a slight increase in prices, average rebar selling prices for Northern region’s steel mills is assessed at around PKR 116,000-117,000/MT, ex-works (USD 723-729) rising by PKR 1000/MT against last week, while Southern (Karachi region) steel mills have kept rebar offers at around PKR 118,000/MT, ex-works which are likely to increase further on rise in construction materials' prices. Assessment of CC billet G-60 stood at PKR 96,000-97,000/MT (USD 598-604) while local scrap price increased to PKR 67,000/MT ex-works.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge