Indian Imported Scrap Market Standstill; Offers Rangebound

Global scrap prices stand stable with HMS 1&2 (80:20) concluded recently at USD 294-295/MT, CFR Turkey. While participants indicate that South Asian scrap prices likely to remain supported in the near terms.

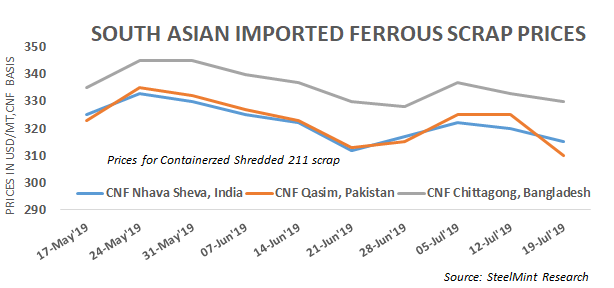

SteelMint’s assessment for containerized Shredded from UK, Europe and USA stands flat at USD 315-320/MT, CFR Nhava Sheva against last week’s report, although few offers were reported even in the range of USD 310-315/MT, CFR no major buying interest was witnessed.

Some Ludhiana and Chennai based scrap importers brought limited scrap in containers on their urgent needs while most of the steel mills in Kandla and West Coast regions were standstill amid sufficient scrap inventories in hand. Turning scrap in limited quantity reported to have sold at USD 270-275/MT, CFR Chennai.

Offers of HMS 1 scrap from Dubai and South Africa origin reported at around USD 305-310/MT, CFR Nhava Sheva. HMS 1&2 (80:20) from Dubai assessed at around USD 300/MT, CFR. West African HMS 1&2 (80:20) assessed flat around USD 290/MT, CFR Nhava Sheva.

"Suppliers in UK, Europe and US are presently observing a good domestic demand thus, prices are not lowering further. This has resulted in very limited availability of cheaper HMS scrap being offered to South Asian countries. Although Shredded was traded at USD 310-313/MT, CFR Qasim earlier this week, now it is being offered at and above USD 315/MT, CFR Qasim" shared a leading trader from India.

There is still a considerable gap between domestic HMS scrap, which is hovering in the range of INR 21,000-21,500/MT, (USD 305-312) ex-Mumbai and the landed cost of any decent quality HMS scrap imported to India. Meanwhile, Sponge Iron prices are competitive making steelmakers to prefer Sponge Iron and importers to keep away from inquiries. Also, production cuts continue as finish steel demand hasn't shown any significant recovery yet.

Indian domestic scrap prices rangebound - Domestic scrap prices also remained rangebound in all major markets. Lowered production seemed to have lowered supply tightness in the market. The current assessment of local HMS 1&2 (80:20) stands at INR 21,000-21,300/MT (USD 305-309), CFR Mumbai, marginally down by INR 200/MT against last week. while Chennai based HMS 1&2 (80:20) assessed at INR 20,500-20,700/MT, ex-works. Indian Rupee remained in the range 68.5-68.8 against USD over the week.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge