Bangladesh: Bulk Steel Scrap Imports Up 14%; Billet Imports Down 59% in FY19

On the other hand, increasing self-reliance in billet production has been reflected in a sharp fall in steel billet imports in FY19. Bangladesh based major mills like BSRM, Abul Khair, GPH Ispat etc have raised billet making capacities recently making the country self-sufficient in billet production. Interestingly, the country witnessed two export shipments of mill scale to Vietnam in FY19, the data showed.

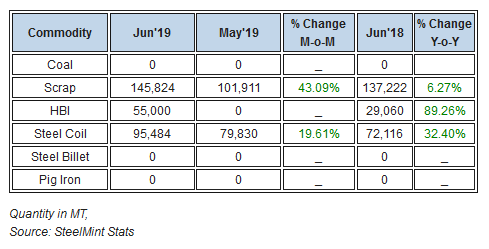

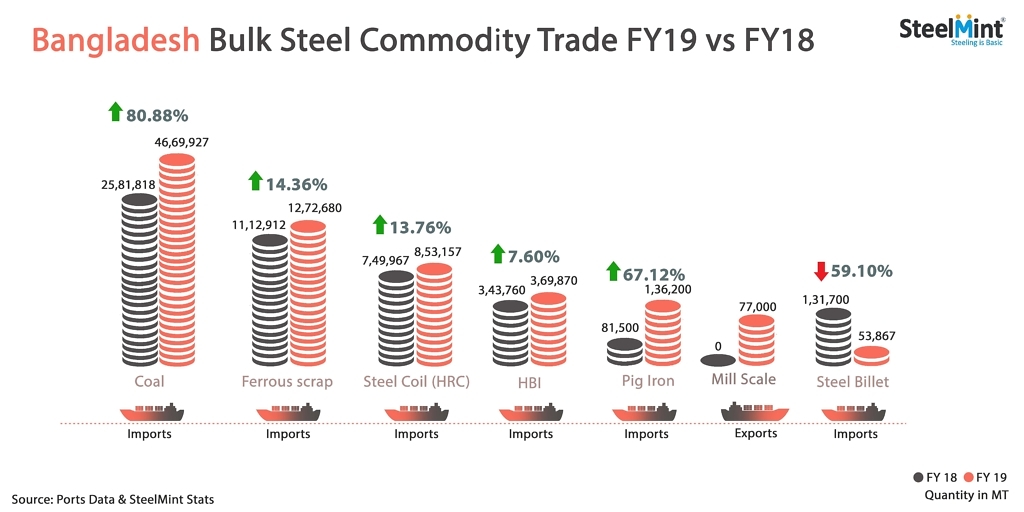

-- Bulk ferrous scrap - The country imported 1,272,680 MT bulk ferrous scrap in FY19 (Jul’18-Jun’19) observing a rise of 14.3% on the year as against 1,112,912 MT bulk scrap recorded in the previous fiscal. Since the data maintained with SteelMint, the country has observed the 4th successive yearly rise in bulk scrap imports.

Increasing production capacities, supportive economic and political situation, number of construction projects by the government has resulted in an increased appetite for ferrous scrap imports against the earlier years. United States remained the largest bulk scrap exporter to Bangladesh occupying almost 75% share followed by other prominent suppliers were UK, Japan and Australia in FY19.

-- Bulk coal imports - Bangladesh coal imports have posted remarkable growth during the Bangladeshi fiscal year FY19. As per the vessel line-up data compiled by SteelMint Research, coal imports taken by the country had increased to 4,669,927 MT in FY19, up 81% compared with 2,581,818 MT in FY18. The enormous import figures had come despite the country claiming nil imports during three months (Jul’18, May’19 and Jun’19) in the fiscal, wherein demand falls owing to bad weather and slack coal intake from the buyers.

The country has witnessed a robust demand for imports after domestic miner-Barakupuria had stopped coal sales for local buyers in order to augment coal supplies for state-run power units. Besides, a fall in global coal pricing had also supplemented imports from Bangladesh. During the FY19, Bangladesh’s coal imports from its major supplier-Indonesia had doubled during the year to 3,618,791 MT. While coal shipments taken from South Africa increased 19% Y-o-Y to 819,246 MT.

-- Bulk steel coil imports - Bangladesh’s steel coil imports elevated by 14% Y-o-Y to 853,157 MT in FY’19 from 749,967 MT in FY’18. Bangladesh’s steel coil imports increased amid lower HRC export offers from China and Japan and improved demand in downstream products. Japan remained the largest supplier of steel coil to Bangladesh occupying 56% share followed by other suppliers were Taiwan, India and Malaysia.

-- Bulk HBI imports - Bangladesh bulk HBI imports recorded at 369,870 MT in FY19 against 343,760 MT in FY18. Ukraine remained the largest supplier occupying 92% share followed by Malaysia in FY19.

-- Bulk steel billet imports - Bangladesh had observed a single steel billet import shipment of 53,867 MT arrived in Jul’18 from Qatar observing a sharp fall by 59% Y-o-Y in FY19. However, the country’s self-sufficiency in billet production could have resulted in nil billet import volumes since last 11 months.

-- Bulk pig iron imports - Bangladesh observed a sharp jump of 67% in total pig iron imports in FY19. Notably, all shipments were seen from India and recorded at 136,200 MT amid price competitiveness against 81,500 MT in FY18.

-- Bulk mill scale exports - Two bulk mill scale export vessels of total 77,000 MT were exported from Bangladesh to Vietnam consisting each 42,000 MT in Nov’18 and 35,000 MT in Mar’19 in FY19. However, bulk mill scale export volume was recorded nil in FY18 and 71,000 MT in FY17.

Codelco seeks restart at Chilean copper mine after collapse

Hudbay snags $600M investment for Arizona copper project

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling