Pakistan: Imported Scrap Prices Up USD 10 in Recent Trades

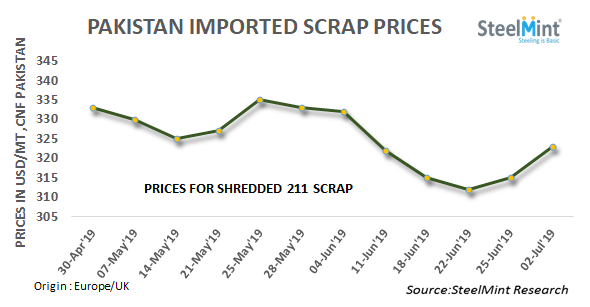

SteelMint learned in recent conversations with industry participants that imported scrap offers have jumped to Pakistan following the rebound in Turkey imported scrap prices in recent deals. Considerable trades of imported scrap has been witnessed despite limited domestic support while few buyers were interested in slightly lower levels than the current offers. Around 5,000-6,000 MT of containerized scrap was heard to have booked in the last couple of days.

SteelMint’s assessment for containerized Shredded 211 scrap from US and UK stands at USD 320-325/MT, CFR Qasim observing a jump by USD 8-10/MT against USD 312-315/MT, CFR levels reported during the last week. Few deals for Shredded scrap in containers reported in the range of USD 322-323/MT, CFR. Leading supplier yards in UK and Europe are offering Shredded scrap in the range USD 323-325/MT, CFR Qasim.

Assessment for Dubai origin HMS remains rangebound around USD 315-320/MT, CFR depending on the quality and South African HMS 1&2 at around USD 315-318/MT, CFR Qasim.

PKR continues volatility against USD - Pakistani Rupee showed a sharp recovery to 156 levels today against the record high of 164 on 27th June against USD. while USD/PKR rate was around 157-158 levels a week ago. Few participants anticipate that further currency depreciation is possible indicating local steel prices to rise further in the coming days.

Mills lower production amid less clarity on sale tax - Most of the manufacturers are still awaiting clarity on adjustment procedures as this is a big shift being implemented from July 1st from last fixed sales tax regime. Most of the mills have stopped their sales and retailers who have stocks in hand are being reported taking advantage by asking higher rates from the end user.

Commercial rebar suppliers based in the Gujranwala’s steel market have stopped their production since the last few days resulting in low demand, thus no significant change in rates of Bala Billet has seen in comparison to rebar prices in the country.

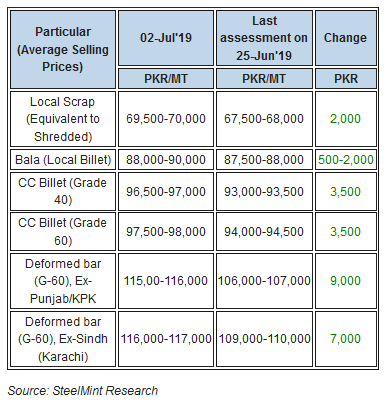

Rebar prices after inclusion of 17% FED jump sharply PKR 7,000/MT (USD 45) against the last week. In Northern region rebar average selling prices assessed at around PKR 115,000-116,000/MT, ex-works (USD 736-742) meanwhile, asking rates of rebar by Southern region (Karachi) steel mills heard at around PKR 116,000-117,000/MT, ex-works which was PKR 96,000-97,000/MT almost 1.5 months back.

SteelMint’s assessment of CC billet G-60 reported at an average selling price of PKR 97,500-98,000/MT (USD 624-627), ex- works. Domestic scrap prices equivalent to Shredded increased to PKR 69,500-70,000/MT (USD 445-448) ex-works inclusive of taxes.

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Newmont nets $100M payment related Akyem mine sale

Gold price rebounds nearly 2% on US payrolls data

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times