Bangladesh: Imported Scrap Prices Rangebound; Market Awaits Clarity on Budget

However, concerns over new budget are still looming in the industry as the steelmakers anticipate that the new tax tariffs imposed on imports of raw materials will significantly increase finished steel prices. On the other hand, local ship recyclers seek clarity on VAT that could lead to a USD 25/LDT decline in scrapped ship import prices.

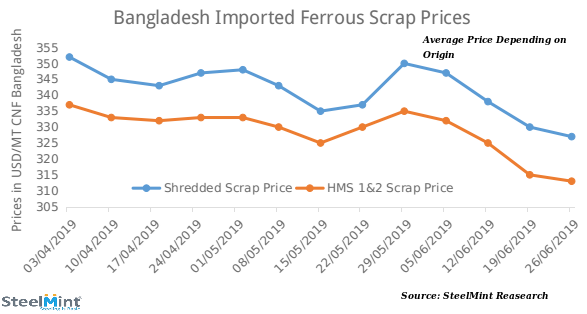

SteelMint’s assessment for containerized Shredded scrap from Europe and North America stands at around USD 325-330/MT, CFR Chittagong, slightly down against the last week’s report of USD 330/MT,CFR levels, with reasonable number of deals getting concluded at lowered prices as steel mills continue to restock. Few USA based scrap yards were reported to offer in the range of USD 330-332/MT, CFR.

Containerized HMS offers were reported to marginally decline against last week, as South American origin HMS 1 is being assessed at USD 315-320/MT, CFR Chittagong while lower grade HMS 1&2 from Australia and USA is being offered at around USD 310-313/MT, CFR.

Amid limited demand, offers for P&S scrap majorly have withdrawn by the suppliers in containers but a few offers heard in the range USD 330-335/MT, CFR, while overall imported scrap prices to Bangladesh remain at 6 months low levels.

Bangladesh domestic steel market has seen improvement in terms of finished steel demand and industry is keeping a positive outlook, although the impact of recent budget especially the new taxes is being carefully watched. According to steelmakers, the expected increase in rebar prices, as a result of the new tax tariffs on ferrous scrap and billets, might affect steel sales in short term as well as infrastructural growth of the country in the long term.

Local shipyard scrap also witnessed downturn with prices falling by around BDT 1,000/MT on the week and currently standing at BDT 34,000-34,500/MT (USD 402-408), as against BDT 35,500/MT reported last week.

Ship plate prices in Chittagong’s market remained more or less stable with local (16 mm & 12 mm) ship plates' offers reported at around BDT 43,000-43,200/MT (USD 509-511) and BDT 42,000-42,200/MT (USD 497-499) respectively ex-works inclusive of local taxes. However, no news of new sale has been reported in the country’s ship-breaking market so far amid nearing fiscal year close.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

NextSource soars on Mitsubishi Chemical offtake deal

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF