Chinese Steel Market Highlights- Week 25, 2019

Meanwhile hopes to end USA China trade war after the telephonic conversation between USA and China’s President boosted trade sentiments in China’s domestic market.

However nation’s export offers continue to decline further as overseas buyers are reluctant to make fresh bookings with the expectations of further downside in steel prices.

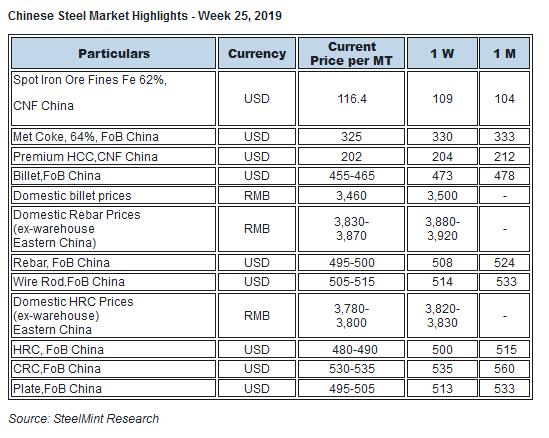

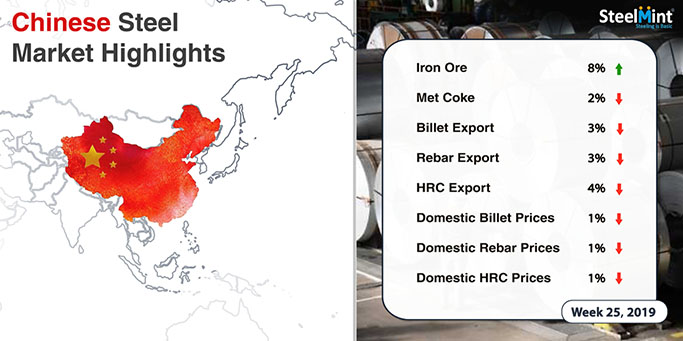

HRC and Rebar offers remained on lower side. Coking coal offers inch down amid weak buying from China. Billet export offers also reported fall, however iron ore prices reported surge.

Chinese spot iron ore prices surge towards the weekend - Chinese spot iron ore fines Fe 62% prices opened up this week at USD 108.20/MT and picked up to USD 116.4/MT.

The prices have increased amid world’s second largest iron ore miner Rio Tinto’s announcement made on reduction of its iron ore Pilbara shipments guidance to 320-330 MnT as against 333-343 MnT previously.

Dalian iron ore future during the week climbed to 820 yuan/MT, the highest since inception in 2013.

As per data compiled by SteelHome consultancy, iron ore inventory fell to 116.75 MnT as against 118.7 MnT last weekend.

Vale on 19th June'19 announced the resumption at its Brucutu mines within 72 hours.As per reports, the president of the Superior Court of Justice overthrows a decision previously taken by a law court in Minas Gerais state, to suspend the use of the Laranjeiras dam, located at Brucutu. The decision will enable full resumption of wet processing at Brucutu, increasing Vale's product portfolio.

Spot lump premium witnessed rise on weekly basis- Spot lump premium witnessed rise on weekly basis at USD 0.3601/DMTU as against USD 0.3300/DMTU, CFR China, a week ago owing to supply concerns.

Spot pellet premium moved down on weekly basis- Spot pellet premium for Fe 65% grade pellets assessed at USD 23.95/MT as against USD 24.35/DMT, CFR China week ago.

Coking coal offers slide further- Seaborne premium low-volatile hard coking coal prices witness further fall amid softening global demand and falling steel prices.

Latest offers for the Premium HCC grade are assessed at around USD 197/MT FOB Australia which was around USD 202.50/MT FoB basis a week back.

China domestic billet prices fall- This week Chinese domestic billet prices settled at RMB 3,460/MT,down RMB 40 against last week. This week, billet trade sentiments in China reported weak.

Chinese HRC export offers witness continual decline- Chinese HRC export offers continue to show downward momentum amid softening overseas demand and pessimistic sentiments prevailing in domestic market.

Currently nation’s HRC export offer declined by USD 5-10/MT and was assessed at around USD 480-490/MT FoB basis. In the beginning of the week the offers stood at USD 495-505/MT FoB basis.

On weekly basis domestic HRC prices in China stood at RMB 3,780-3,800/MT in eastern China (Shanghai) tumbled by RMB 30-40/MT this week which was RMB 3,820- 3,830/MT in eastern China (Shanghai) in previous week.

Meanwhile towards the end of this week buying sentiments improved amid gains in futures market.Also hopes of US-China trade dispute to end led to a rebound in domestic HRC prices in China. However downstream demand continued to remain on lower side.

Chinese rebar export offers move down further- Nation’s rebar export offers fall further on weekly basis as sentiments in nation’s domestic market remain subdued since the beginning of this week.

On weekly basis nation’s HRC export offers fell by USD 5-10/MT. Currently nation’s rebar export offers are at USD 495-500/MT FoB China. Last week the offers were at USD 507-510/MT FoB basis.

Meanwhile domestic rebar prices stood at RMB 3,830-3,870/MT (Eastern China) plunged by RMB 50/MT W-o-W basis which was RMB 3,880-3,920/MT (eastern China).

However towards the end of this week chinese steel market gain momentum over higher futures market. This may lead to increase in rebar exports offers and improve trading activities in upcoming days.

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Newmont nets $100M payment related Akyem mine sale

Gold price rebounds nearly 2% on US payrolls data

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times