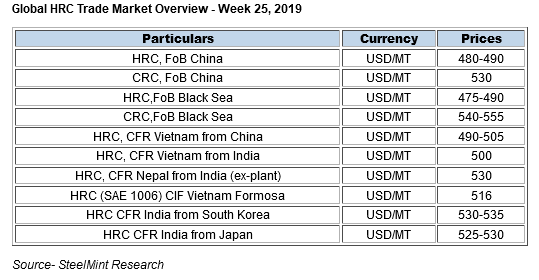

Global HRC Market Overview - Week 25, 2019

However in the month of May Indian HRC import offers from Japan was assessed around USD 540/MT CFR basis. Thus HRC offers reduced by USD 15/MT on monthly basis.

Meanwhile, in previous week South Korea based major steel mill reduced HRC export offers for India by USD10/MT and are offering at USD 530-535/MT CFR basis for July shipments.Few trade sources confirmed that around 20,000 MT has been booked for July shipments.

Indian HRC export prices to Nepal decline for July shipments- Market sources shared with SteelMint that major Indian steel mills lowered their HRC export offers to Nepal on recent bookings concluded.

As per an update received, a govt owned steel mill booked around few rakes of HRC last week with Nepal at around USD 530/MT (ex-plant) for end June shipments.

Also trade sources shared that,”Nepal based steel mills witness its financial year closing due to which customers have postponed their purchases and are reluctant to make any fresh bookings” .

Chinese HRC export offers reduce further over weakening domestic market- Nation’s HRC export offers is showing downward momentum owing to gloomy market sentiments and dull trades prevailing in domestic market .

Also limited demand from overseas buyers lead to continual decline in HRC export offers from China significantly.

Currently nation’s HRC export offer declined by USD 10-15/MT W-o-W basis and assessed at USD 480-490/MT FoB basis.Last week the offers stood at USD 495-505/MT FoB basis.

Meanwhile domestic HRC prices in China fell significantly by RMB 50-60/MT and is hovering at RMB 3,730-3,750/MT D-o-D basis in eastern China (Shanghai).

And prices at Northern China fell by RMB 50-60/MT and stood at RMB 3,740-3,750/MT in Northern China (Tangshan).

Imported HRC Offers to Vietnam drop further over ample supply- Imported HRC offers to Vietnam drop further over dull trades and higher inventory levels among end users. Meanwhile Vietnam based domestic steel producer Formosa is also offering HRC to end users in Vietnam at competitive prices.

Thus company revise its monthly offers this week by reducing HRC (skin pass SAE1006) offers by USD 25/MT at USD 516/MT CIF basis for July Aug shipments which was USD 541/MT CIF basis in previous month.

Current HRC trades to Vietnam - Week 25, 2019

1.HRC (SAE 1006) 2-3mm/Chinese offer- Benxi steel is at USD 505/MT CFR Vietnam.

2.HRC (SAE 1006) 2-3mm/Chinese offer- Laiwu Steel is at USD 490/MT CFR Vietnam.

3.HRC (SAE 1006) 2-3mm/Indian offer- Indian steel mill is at USD 495-500/MT.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

NextSource soars on Mitsubishi Chemical offtake deal

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF