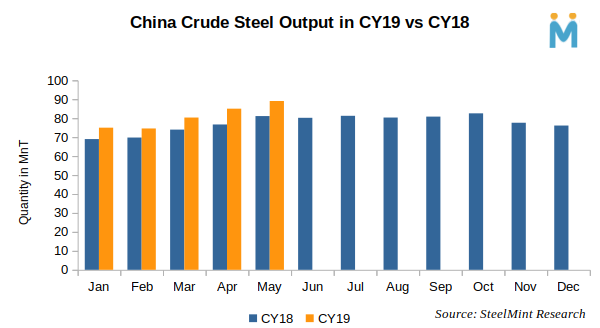

Chinese Crude Steel Output Hits Record High in May’19

Nation’s crude steel output clocked almost 4 years high in May’19, since data maintained with SteelMint.

On monthly basis China’s crude steel production increased by 5% in May’19 to 89.09 MnT which was 85.03 MnT in Apr’19.

Absence of strict production curbs in summer season resulted to surge in nation’s production volume. Meanwhile, increased profit margins along with robust demand from construction, infrastructure and real estate sector motivated steel mills to increase production.

However in mid-May Chinese steel prices started to tumble amid volatile futures along with intensifying trade tension between USA and China; this led to bearish sentiments in nation’s domestic and overseas market.

On yearly basis nation’s crude steel output ascended by 10% in May’19 against 81.13 MnT in same month of previous year.

During first five months of CY’19 (Jan-May) China’s crude steel output stood at 404.03 MnT witnessed an increase by 9% which was 370.6 MnT in similar time period of previous year.

Outlook for Jun’19- Hike in iron ore prices due to supply disruptions from Vale owned Brumadinho Dam resulted in lower profit margins of steel mills which may curtail output in upcoming months.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift