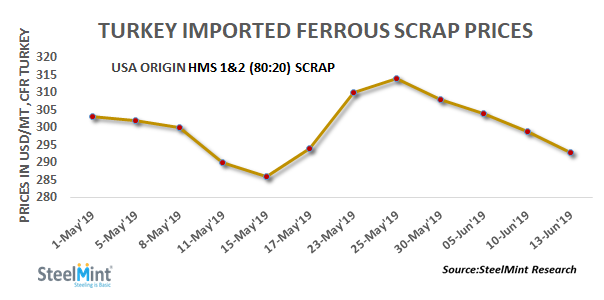

Turkey: Imported Scrap Prices Drop to 1-Month Low in Recent Deals

Following weakening prices in the Turkish market, South Asian and East Asian scrap importers have turned cautious amid continued price fall. However, few participants indicated that further price correction is limited as prices have dropped to around 1 month low and may reach the bottom soon.

In recent deals reported, one of the leading US origin recyclers sold HMS 1&2 (80:20) at USD 293/MT, Shredded at USD 298/MT, CFR and Bonus scrap at USD 303/MT, CFR Turkey to the Marmara based steelmaker.

-- Another US supplier sold HMS 1&2 (80:20) at USD 292/MT and Shredded at USD 297/MT, CFR Turkey to the same steelmaker.

-- Another supplier sold a cargo comprising 2,000 MT HMS 1&2 (80:20) at USD 293/MT, 23,000 MT of Shredded at USD 298/MT and 2,000 MT P&S scrap at USD 303/MT, CFR Turkey.

-- A Izmir based steelmaker booked a cargo comprising 17,000 MT HMS 1&2 (80:20) at USD 293/MT, 12,000 MT of Shredded at USD 298/MT and 5,000 MT of Bonus at USD 303/MT, CFR.

After normalizing these deals, SteelMint’s assessment of US origin HMS 1&2 (80:20) scrap has lowered to USD 292-293/MT, CFR Turkey, down by USD 5-6/MT against the last report. In line with this, an assessment of Europe origin HMS stands at around USD 287-288/MT, CFR. A premium of US material over Northern European scrap stands at around USD 4-5/MT.

-- Earlier to these deals, an Iskenderun based steelmaker booked a Canada origin cargo, comprising 10,000 MT Shredded HMS 1&2 (95:5), 8,000 MT of rails and 12,000 MT of P&S at an average price of USD 305/MT, CFR

-- Another US cargo booked comprising 12,000 MT of HMS 1&2 (90:10), 16,000 MT of Shredded and 2,000 MT of Bonus at an average price of USD 300/MT, CFR Turkey.

Finish steel demand remains slow; prices flat - Turkish finish steel demand remains low while rebar reference export prices stand flat at USD 465-480/MT, FoB Turkey.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

NextSource soars on Mitsubishi Chemical offtake deal

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF