Vietnam: Limited Deals Keep Imported HRC Offers Under Pressure

Meanwhile ample supply of imported material and sluggish demand in downstream products in Vietnam market has kept imported HRC offers on downside.

Buyers in Vietnam are expecting further fall in export offers from China. Thus they have postponed their purchase plans and will book material later since they are holding enough stock in hand. Thus no major deals were reported in the beginning of the week.

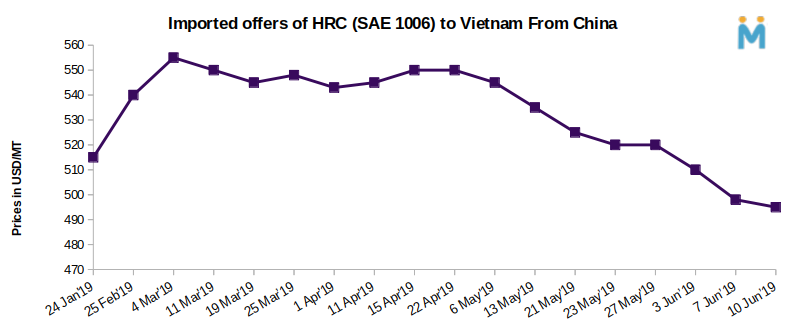

Also as per SteelMint price assessment, imported HRC offers to Vietnam slashed by USD 30-35/MT on monthly basis to USD 505/MT CFR in June’19 which was USD 540-545/MT CFR basis in month of April’19.

Current HRC trades to Vietnam - Week 24, 2019

1. HRC (SAE 1006) 2-3mm/Chinese offer- Bao Steel is at USD 505/MT CFR Vietnam. Towards the end of last week the offers was at USD 510/MT CFR basis.

2. HRC (SAE 1006) 2-3mm/Chinese offer- Laiwu Steel is at USD 495/MT CFR Vietnam. Towards the end of last week the offers was at USD 498/MT CFR basis.

3. Towards the end of last week confirmed trade deal was heard of around 10,000 MT of HRC booked from China based Laiwu Steel to Vietnam at USD 498/MT CFR basis.

4. HRC (SAE 1006) 2-3mm/Japanese offer- Nippon Steel is at USD 535/MT CFR basis remain unchanged on weekly basis.

5. HRC (SAE 1006) 2-3mm/Brazil offer- Arcelor Mittal is at USD 510/MT CFR basis.

6. HRC (SAE 1006) 2-3mm/Indian offer- TATA Steel is at USD 500/MT. Towards the end of last week offers were around USD 505/MT CFR basis.

7. HRC (SAE 1006) 2-3mm/Russia offer- MMK Steel is at USD 495/MT CFR basis.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling