Pakistan: Domestic Steel Prices Shoot Up Amid Currency Devaluation

Pakistan Rupee has devalued again to new all-time record high levels of 153-154 today against USD from 147-148 levels closing last week. After the government reached a preliminary agreement with the IMF for USD 6 billion bailout, on last Thursday Rupee had devalued to 147-148 depreciating by 4-5% against 141 against USD.

Local steel prices surge by PKR 3,000-4,000/MT on W-o-W basis - Domestic steel prices in Pakistan witnessed a sharp rise after currency devaluation. Many of the steelmakers have increased their asking rates following rise in steelmaking costs amid jump in prices of electricity, fuel and gas in Pakistan. However, demand remained very limited amid ongoing Ramazan month lull and the overall depressing situation in the market.

“The sliding rupees has caused alarm in Pakistan, as a result local steel prices have increased sharply by around USD 20-25/MT in line with an expected jump in electricity, fuel and gas prices in the country. Most of the steelmakers are holding their sales of finished products and semi-finish steel waiting for the currency to stabilize again.” shared a source.

Domestic scrap prices equivalent to Shredded surged to PKR 63,000-63,500/MT (USD 414-417) ex-works inclusive of taxes, up PKR 3,000/MT (USD 20) against last week. SteelMint’s assessment of local billet after currency depreciation stands at PKR 81,500-82,000/MT (USD 535-539) ex-works.

Rebar prices in the Northern region increased to PKR 100,000-101,000/MT, ex-works (USD 657-663) meanwhile, Southern region rebar average selling prices reported at PKR 102,000-103,000/MT, ex-works. Asking rates of leading mills in Southern region for rebar G-60 reported at around 104,000-105,000/MT that of in the Northern region at 102,000-103,000/MT, ex-works inclusive of local taxes.

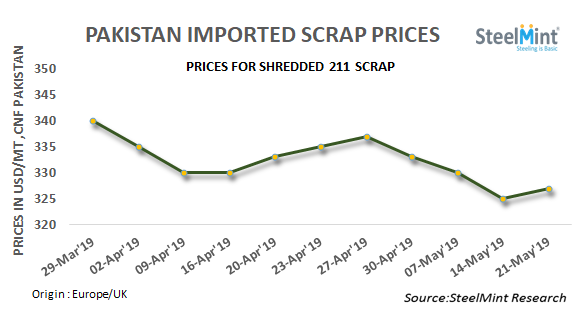

Imported scrap prices turn slightly up; demand remains limited - SteelMint’s assessment for containerized Shredded scrap from UK and Europe stands at USD 325-327/MT, CFR Qasim, up USD 3-5/MT against last weeks’ report of USD 320-325/MT, CFR. Shredded traded in very limited quantities at around USD 325-328/MT, CFR.

Few buyers were interested to buy more scrap amid very low domestic scrap availability. However, after a recent price hike in Turkey, most of the suppliers have turned resistant to offers at low levels. Sellers turn bullish and very limited offers are being quoted at the moment in the global market.

An assessment of Dubai origin HMS 1 scrap stands stable at USD 330-333/MT, CFR depending on quality while South African HMS 1 is being reported at around USD 328-330/MT, CFR Qasim. Notably, scrap prices had fallen to 4 month low last week.

Electricity & Gas prices to rise further - As per reports, Central Power Purchasing Agency (CPPA) has sent a request to NEPRA to raise electricity price by PKR 0.57 per unit after witnessing increase fuel price in Apr’19. Oil and Gas Regulatory Authority (OGRA) has recently recommended up to 47% increase in the prices of gas for the fiscal year 2019-2020 in Pakistan.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling