What is driving Up China’s Steel Output amid Production Restrictions?

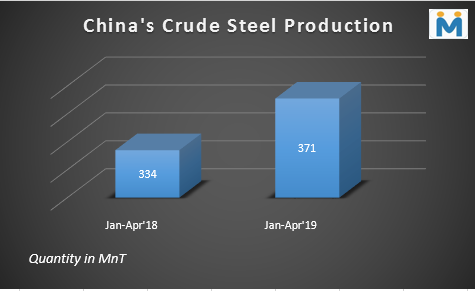

During Jan-Apr’19, China churned out 370.86 MnT of crude steel, up by 11% against the corresponding period of the previous year.

Now, as the crude steel output has reached to an absolute high volume, the question that is hovering in the minds of the market participants is that will the steel supply in China continue to increase in the time ahead despite the policy restrictions announced by the government in a bid to improve the air quality.

Since the commencement of national supply-side reform on steel overcapacity, the Chinese government has repeatedly issued directives insisting that “There is no way to increase steel production capacity by any means” and gradually phasing out backward capacity.

According to statistics, in 2016, 2017, and 2018, China had resolved to cut the excess capacity of steel by 45 MnT, 50 MnT and 30 MnT respectively, and the actual cumulative crude steel capacity reached more than 150 MnT during time span of three years (in 2016, the actual capacity resolved was over 84.91 MnT).

China’s capacity swap program contributing to rising production

Subsequently, in theory, the country’s crude steel capacity should have been effectively controlled. However, does this mean that there is limited room for further release of crude steel capacity in the later period? The answer is ‘not necessarily’. This is because as per the market sources, China’s steel capacity replacement document mentioned that there will be 112 MnT of legitimate capacity that will be replaced and put into the market in the next 2-3 years. Although the government has repeatedly stressed upon the principle of swapping for less in replacement, there are always countermeasures in the execution of the policy. Driven by ultra-high profits, the future crude steel capacity may still have further room for growth.

Surge in production due to good profits

Prices have been on a bullish trend this year supported by stable downstream demand and higher raw materials prices. The downstream construction segment in China underwent positive growth in the first quarter of 2019 in line with the ramp-up in the country’s domestic steel production.

The size area of new construction increased by 13.1% year on year to 585.52 million square meters in the first four months of 2019, with residential and office buildings the largest contributors to the strong growth in size and sales while sales of commercial housing increased by 8.1% to 3.91 trillion.

In a statement from China’s biggest steel manufacturer, Baowu Steel, although the demand from infrastructure and automobile sector has turned tepid in first four months of 2019 and will continue to remain the same for rest year, the infrastructure sector remains relatively robust driving the production.

As per the market research on major steel mills in the country, the sale of billet in the domestic market is still giving a profit of RMB100-400 per tonne whereas in case of rebar sale, the electric arc furnace and blast furnace enterprises still have a profit of RMB 200-800 per tonne. Thus, driven by high profits, steel mills are continuing their production, and even worse, some mills tried all out in pursuit of high output. From the perspective of steel mills, higher profits will inevitably lead to higher output and if this trend continues the output is likely to surge further.

On the whole, it is believed that under the current situation of high profit per tonne of steel, unless the government introduces high-pressure policy to strictly control the production, the probability of further increase in crude steel output in the later period still higher and if the demand cannot catch up later, a new round of overcapacity is not far off.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift