Global Ferrous Scrap Market Overview - Week 20, 2019

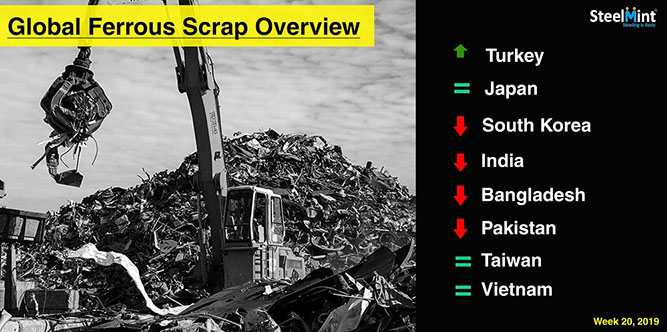

Turkey steel mills have booked deep sea cargoes at rebounded prices towards the closing of the week. Japanese scrap prices remained flat. South Korean steelmakers booked bulk cargoes from US & Russia at further lowered prices. Trades in containers to Asian countries remained limited on low demand from domestic markets.

Turkey imported scrap prices recover after US halved tariffs on steel - Turkish steel mills booked deep sea cargoes at corrected prices of USD 283-285/MT, CFR from Europe and Baltic origins in the first half of the week however prices rebounded by USD 5-6/MT in deals reported towards the closing of the week from US suppliers.

In a recent deal reported from US supplier HMS 1&2 (80:20) sold at USD 294/MT and Bonus scrap at USD 304/MT, CFR Turkey. With the decision of US regarding extra tariff cut on Turkish steel products, it is being anticipated that rebar, billet and scrap prices would recover sharply in short terms.

SteelMint’s reference price for US origin HMS 1&2 (80:20) scrap stands at USD 292-294/MT, CFR Turkey. While assessment of Europe origin stands at around USD 288-289/MT, CFR. A premium of US material over Northern European scrap stands at around USD 4-5/MT.

Japan Tokyo Steel’s scrap purchase price remains unchanged - Japan’s Tokyo Steel is paying JPY 29,000/MT (USD 263) for H2 scrap delivered to Utsunomiya plant in Kanto region stable against last week. However, South Korean Hyundai steel lowered bids for Japanese H2 by JPY 500/MT to JPY 30,500/MT, FoB (USD 278) and reported to have booked around 70,000 MT H2 this week.

South Korean steelmakers book bulk scrap cargoes from Russia - South Korean Hyundai Steel booked two bulk ferrous scrap cargoes this week comprising total 25,000 MT from Russia. It booked 15,000 MT A3 scrap in the beginning of the week at USD 302/MT and another deal of 10,000 MT at USD 300/MT, CFR South Korea towards the closing of the week. Dongkuk Steel booked US cargo comprising 27,000 MT equivalent HMS 1 at USD 308/MT, CFR, down further USD 4/MT against last week.

China's Shagang steel cuts scrap purchase price by USD 6/MT - Eastern China’s one of the largest private ferrous scrap consumer and EAF steelmaker - Shagang Jiangsu Steel group has lowered steel scrap purchase price for all grades by RMB 40/MT (USD 5.8) from 15th May’19. Shagang Steel is paying RMB 2,580/MT (USD 375) inclusive of 13% VAT for HMS (6-10 mm thickness) delivered to headquarter works situated in Zhangjiagang north of Shanghai. Prices lowered following rising supply and lowering profit margins.

Indian imported scrap prices expected to recover after election results - Indian imported scrap market observed trades at corrected prices in the beginning of the week, however, towards the closing of the week price hike in Turkish market turned sentiments positive in terms of prices. The outcome of ongoing elections to be revealed on 23rd May kept importers waiting & seeking more clarity on global levels amid indications of recovery in coming days.

SteelMint’s assessment for containerized Shredded from Europe, UK and US stand at USD 320-325/MT, CFR Nhava Sheva, down USD 5-10/MT against last week. Steel mills reported to have booked few trades for Shredded at USD 317-325/MT, CFR depending on payment terms, however, offers from leading scrap yards remain in the range of USD 325-330/MT, CFR.

Amid limited working hours during ongoing Ramadan, Dubai based offers remained limited with HMS 1&2 trades reported at USD 323-327/MT, CFR Nhava Sheva and HMS 1 at USD 328-330/MT, CFR. Offers for South African HMS 1&2 stand in the range of USD 325-330/MT, CFR that of West African HMS 1&2 in 20-21 MT containers stand in the range of USD 310-315/MT, CFR India.

Domestic HMS 1&2 (80:20) price assessment lowered by INR 300/MT on weekly basis to INR 23,200-23,500/MT (USD 330-335), ex Chennai while remained stable at INR 24,800-25,000/MT (USD 353-356), ex- Mumbai.

South East Asia observed limited trades - US origin imported HMS (80:20) prices reported around USD 277-280/MT, CFR Taiwan while in 20ft containers at USD 305/MT, CFR Jakarta. P&S in 20ft containers were traded from UK at around USD 342-345/MT, CFR Jakarta and from Singapore at USD 351/MT, CFR Jakarta. US origin HMS 1&2 in bulk was being offered around USD 315-320/MT, CFR Vietnam.

Pakistan’s local steel prices to recover on sharp currency depreciation - Pakistan Rupee depreciated by 5% to 147-148 levels against USD. Imported scrap offers reached 4 month low following the global price correction. Shredded scrap traded at USD 320-325/MT, CFR Qasim, down USD 4/MT against last week closing, however top suppliers continue offering at a premium of 3-5 USD. Dubai origin HMS 1 stands at USD 330-333/MT, CFR amid continued Ramadan slowdown, while South African and UK HMS 1 at USD 326-328/MT CFR and USD 310-315/MT, CFR Qasim.

Scrap equivalent to Shredded price dropped by PKR 1000 at PKR 60,000-60,500/MT while Bala Billet price dropped by PKR 500/MT at 78,000-78,500/MT ex-works.

Bangladesh imported scrap buying interest turns dull amid weak finish steel sales - Bangladesh steel mills showed limited buying interest with already filled inventory amid ongoing Ramadan slowdown. Prices have dropped due to the lowering of global offers.

Assessment for Shredded scrap from USA and UK dropped USD 5-10 from last week and stands at USD 335/MT, CFR. HMS 1 offers from South America dropped USD 8-10 to USD 325-330/MT CFR, while P&S assessment dropped to USD 350/MT, CFR Chittagong.

Domestic scrap continued to decline W-o-W with shipyard scrap prices assessed at BDT 34,000-34,500/MT (USD 414-420). Ship plate scrap prices dropped to BDT 43,300-43,500/MT (USD 511-513) and BDT 42,300/MT (USD 500) for 16mm and 12 mm respectively inclusive of taxes.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling