Vietnam Ferrous Scrap Imports Hit 7 Year High in Apr'19

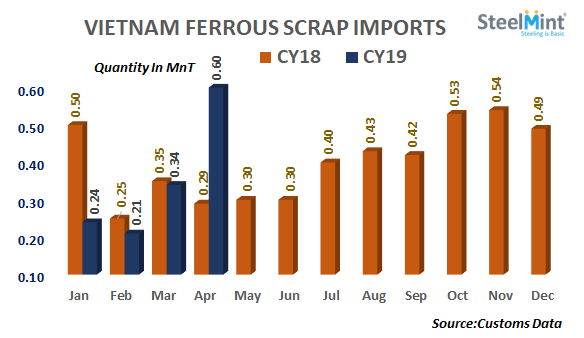

Vietnam witnessed a huge increase by 77% M-o-M in Apr’19 as it imported 597,611 MT ferrous scrap as against 338,559 MT ferrous scrap recorded in Mar'19, the recent data released by the customs department showed.

Notably, this is the highest monthly import volume recorded in the last 7 years since the data maintained with SteelMint. Prior to this, highest was recorded at 537,312 MT ferrous scrap imports in Nov'18. A sharp increase in bulk cargo bookings and restocking observed ahead of Golden Week holidays in Japan could have resulted in imports hit 0.6 MnT mark in Apr'19.

On yearly premises, imports almost doubled witnessing a rise of 103 % Y-o-Y as against 293,781 MT in Apr’18.

Imported scrap offers to Vietnam continued downtrend in Apr'19 - Vietnam's imported scrap prices continued downtrend amid lowering of both Japanese offers and global scrap prices in Apr'19. Vietnamese steel mills had booked bulk cargoes actively in Feb-Mar'19 after imports hitting 3 years low in Feb'19 which also has resulted in increased imports in Apr'19.

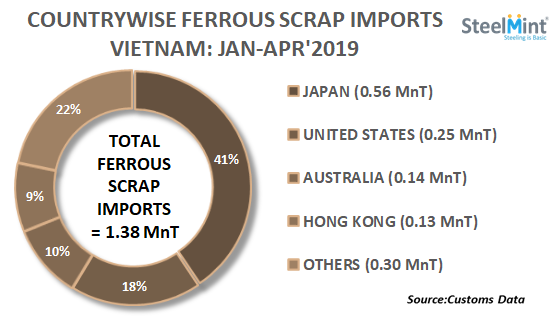

Japan remained the largest scrap supplier in Apr’19 - Japan exported 180,940 MT ferrous scrap occupying a share of 30% in total imports, remaining almost stable M-o-M as against 181,843 MT in Mar’19.

US regained the 2nd largest supplier position as it supplied 139,078 MT, rising 113% M-o-M as against to 65,125 MT in Mar’19. US occupied 23% share in total scrap imports. Followed by other prominent scrap suppliers were Australia (73,140 MT) and Hong Kong (39,154 MT, up 10% M-o-M) with 12% and 7% of share respectively. Shipments from Australia also increased significantly in April as compared to slower bookings witnessed in Q1 CY'19.

Vietnam’s crude steel production recorded at 4.08 MnT in Q1 2019, up considerably 45% Y-o-Y against 2.81 MnT produced in Q1 2018 while marginally down 4% on a quarterly basis against 4.27 MnT recorded in Q4 2018.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift