Pakistan: Imported Scrap Prices Hit 4 Month Low amid Sharp Fall in Global Offers

With ongoing Ramadan, scrap procurement has remained low due to limited demand. Most of the participants have turned cautious on declining markets amid a lot of availability of offers from supplying yards.

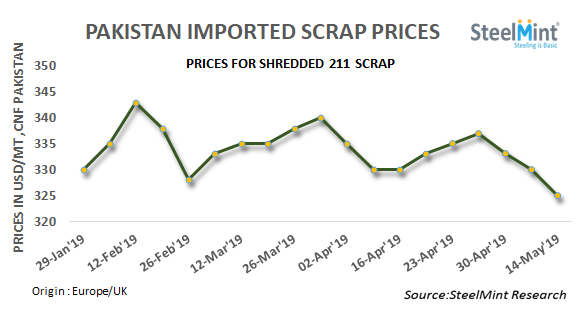

SteelMint’s assessment for containerized Shredded scrap from UK and Europe stands at USD 320-325/MT, CFR Qasim, down by 5-7 USD/MT against USD 327-332/MT, CFR levels that were seen during opening last week. Shredded scrap offers by leading scrap yards from UK and Europe are still hovering in the range of USD 325-330/MT, CFR, however limited offers from other average grade yards heard at around USD 320/MT, CFR Qasim. Notably, Shredded scrap prices have hit 4 months low against the same levels seen in Jan'19.

Supply from Dubai remained very low amid Ramadan slowdown. Offers from Dubai for HMS 1 are reported at USD 330-333/MT depending on quality stable against last week, while UK origin HMS 1 was being offered at USD 310-315/MT, CFR. South African origin HMS 1 is assessed at around USD 326-328/MT, CFR Qasim.

Local steel market remained stable - Domestic steel market continued to be slow with ongoing Ramadan holidays while few steel mills are operating at a lower capacity to avoid losses. Low demand due to limited construction projects has kept the market slow.

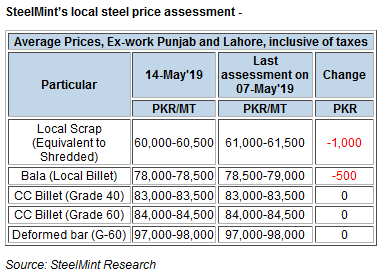

Domestic ferrous scrap prices fall marginally - Domestic scrap prices equivalent to Shredded was being reported at PKR 60,000-60,500/MT (USD 424-427) ex-works inclusive of taxes, falling slightly by 1000 PKR/MT against last week due to the continuation of limited demand.

SteelMint’s assessment of local billet stands at PKR 78,000-78,500/MT (USD 551-554) ex-works. Rebar prices in Northern region prices stable at PKR 97,000-98,000/MT, ex-works (USD 685-692) however few mills eye for higher prices in the near terms. Meanwhile, Southern region prices reported at PKR 98,000-99,000/MT, ex-works, as asking rate of leading mills in Southern region continues around 100,000 PKR/MT, ex-works inclusive of local taxes.

IMF finalizes USD 6 Billion bailout package - As per reports, The International Monetary Fund (IMF) and Pakistan have finally agreed on terms for a USD 6 bn bailout package, to be disbursed over a span of more than three years to face challenging economic environment, with lacklustre growth, elevated inflation, high indebtedness, and a weak external position. Participants are in wait and watch mode to see its impact on the local steel market. Pakistani Rupee remained almost stable at around 141.6 levels against US Dollar.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling