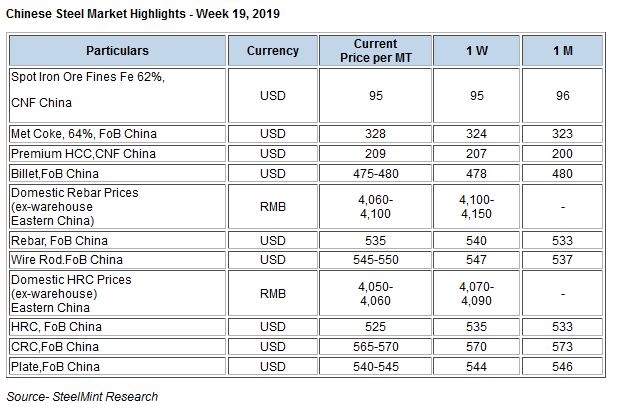

Chinese Steel Market Highlights - Week 19, 2019

Nation’s HRC and rebar export offers witnessed decline this week. However coking coal offers moved up amid improved buying from steelmakers in China and Iron ore prices inched up this week amid tight supply.

China iron ore imports fell 18 months low in Apr’19. China recorded fall of 7% in iron ore imports to 80.77 MnT in Apr'19 against 86.42 MnT in Mar'19.The drop is amid supply disruption from Brazil & Australia and preference of domestic pellet and concentrate.

Nation’s finished steel exports in Apr’19 stood at 6.33 MnT, unchanged as compared to previous month.

Baosteel recently announced flat steel prices for June deliveries. The company has rolled over its flat steel prices for second consecutive month.

Chinese spot iron ore prices inch up - Chinese spot iron ore prices opened up this week at USD 93.10/MT, CFR China and increased to USD 95.45/MT towards the weekend due to supply crisis from Vale over delay in resumption at Brucutu mines.

Iron ore inventory at major Chinese port dropped to 133.35 MnT this week as against 133.6 MnT towards last weekend.

Spot lump premium witnessed at USD 0.3200/DMTU CFR China this week, up as against USD 0.3150/DMTU CFR China towards last weekend. The increase is supported due to constraint supply of lumps.

Lump inventory at major Chinese ports has dropped on weekly basis to 15.5 MnT assessed on 10th May as against 15.7 MnT assessed on 5th May.

Spot pellet premium picked up W-o-W-: Spot pellet premium for Fe 65% grade pellets increased to USD 33.40/DMT, CFR China this week, against 30.40/DMT a week before. Mills are changing blending ratio by using more pellet and is likely to continue amid supply concerns for lumps. Besides, pellet is being favored in China due to cost effective measures.

Coking coal offers inched up on weekly basis- Seaborne premium hard metallurgical coal prices witness increase on weekly basis amid improved buying from mills in China.

The Chinese market saw consistent demand for Australian hard coking coal particularly with low ash content. However tight supply of low ash coking coal cargoes in the spot market might prove challenging to fulfill such a specific need in coal blending.

Latest offers for the Premium HCC grade are assessed at around USD 209.25/MT FOB Australia.Previous week the offers was hovering at USD 206/MT FoB basis.

Chinese billest prices remain largely stable- The ex-factory price of general carbon billet in Tangshan, Changli and Qian’an areas was learned to be around RMB 3,580/MT on 10 May'19

Chinese HRC export offers decline on weekly basis - Chinese HRC export offers moved up in the beginning of the week,however witness decline by the weekend.

Currently nation’s HRC export offer is assessed at around USD 520-525/MT FoB basis. Last week the offers stood at USD 530-535/MT FoB basis.

Meanwhile prices in eastern China (Shanghai) stood at RMB 4,050-4,060/MT which was RMB 4,070-4,090 in the beginning of the week post May day holidays.

And prices at Northern China moved up by RMB 10-20/MT D-o-D basis and stood at RMB 3,940-3,950/MT in Northern China (Tangshan).

Chinese rebar export offer weakens- Currently nation’s rebar export offers are at USD 535/MT FoB China. Last week the offers were at USD 540/MT FoB basis.Major steel mills kept rebar export offers at USD 540-550/Mt FoB basis.

However domestic rebar prices stood at RMB 4,060-4,100/MT (Eastern China).However prices in previous week stood at RMB 4,100-4,150/MT inclusive of VAT taxes.

And prices at Northern China stood at RMB 3,930- 3980/MT basis in Northern China (Tangshan) which was RMB 3990-4040/MT inclusive of VAT taxes.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge