Vale- Iron Ore & Pellet Production Down Q1 CY19 Amid Brumadinho Dam Rupture

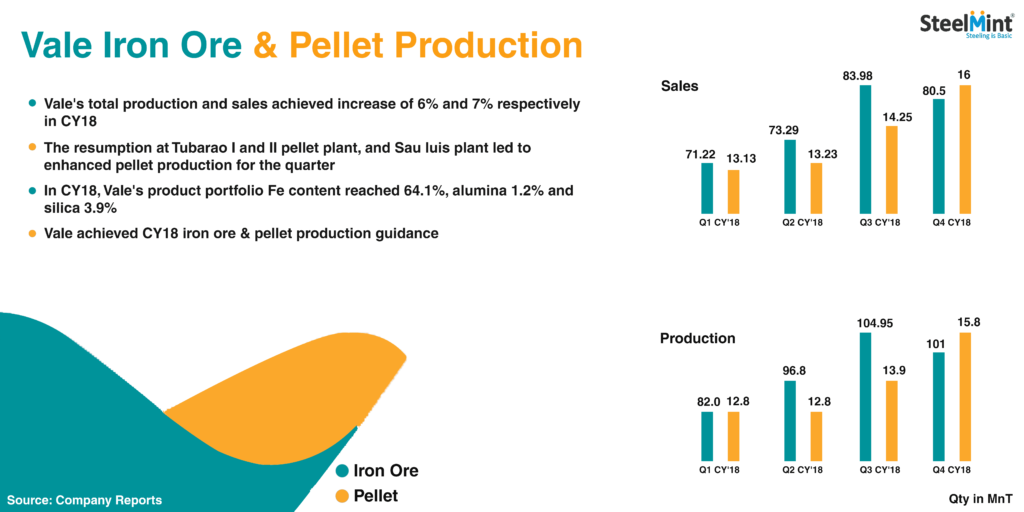

The total iron ore production for the quarter stood at 72.9 MnT, down 28% as against 101 MnT in Q4 CY18. On yearly basis, production fell 11% against 82 MnT in Q1 CY18.

Vale pellet production down 23% Q-o-Q

The miner recorded decline in total pellet output for the quarter at 12.2 MnT, down 23% compared to 15.8 MnT in Q4 CY18. On yearly basis, production recorded 5% drop as against 12.8 MnT in Q1 CY18. The drop was owing to operation halt at Fabrica and Vargem Grande pellet plants due to dam rupture and scheduled maintenance at Tubarao and Oman.

Iron ore & pellet sales down 30% in Q1CY19

Vale recorded iron ore sales at 55.4 MnT for Q1 CY19, down 31% on quarterly basis as compared to 80.5 MnT in Q4 CY18. The iron ore sales fell 22% against 71.22 MnT in Q1CY18. The decline in sales is attributed to production stoppage in Jan'19, and rains impacting shipments from the Ponta da Madeira port in the Northern System. Also, new inventory management procedures at Chinese ports impacted sales by reducing port operational capacity.

Pellet sales for the quarter witnessed by the company at 12.3 MnT, down 23% as compared to 16 MnT in Q4 CY18.

The Oman pellet plant production was 2.0 MnT in Q1 CY19, 25% and 11% lower than in Q4 CY18 and Q1 CY18, respectively, due to scheduled maintenance at line A in January and line B in February.

Sales volume contributed 81% of high grade product

Vale's share of premium products (pellets, Carajás, BRBF, pellet feed and sinter feed low alumina) for Q1CY19 stood almost in line with previous quarter at 81%.

Vale's product portfolio for the quarter reached Fe 64.3%, alumina 1.2% and silica 3.5% as against Fe 64.1%, alumina 1.2% and silica 3.9% in 2018.

FY 19 Guidance: Vale reaffirms its iron ore and pellet sales estimate for the year to be at the low to mid-end of 307-332 MnT.

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

China quietly issues 2025 rare earth quotas

BHP delays Jansen potash mine, blows budget by 30%

BHP, Lundin JV extends useful life of Argentina copper mine

Gold price eases after Trump downplays clash with Fed chair Powell

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

KoBold signs Congo deal to boost US mineral supply

Spring Valley gold project in Nevada gets federal approval

Copper price pulls back sharply ahead of US tariff deadline

Teck approves $2.4B expansion of Highland Valley Copper

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell