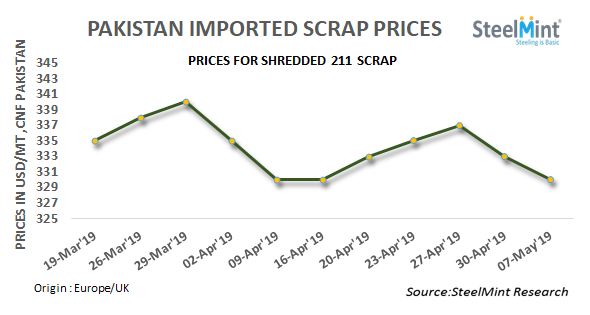

Pakistan: Imported Scrap Prices Soften; Trades Limited Amid Ramadan

Most of offices and banks remained closed today on starting of Ramadan month also, buying inquiries heard limited in the market. Many of the importers are waiting for more clarity on global prices.

SteelMint’s assessment for containerized Shredded scrap stands at USD 327-332/MT, CFR Qasim, slightly down against USD 332-325/MT, CFR levels that were seen during last week. Offers for Shredded scrap from UK and Europe heard USD 327-332/MT, CFR Qasim. Offers from US were hovering in the range of USD 325-328/MT, CFR Qasim but no major deal reported.

“Although global scrap prices corrected considerably in bulk cargoes sold by US suppliers recently, offers in containers for Shredded scrap have softened marginally amid limited global availability. On the other hand, Pakistan scrap importers may continue regular procurement on limited scrap inventories in hand” shared a source.

Offers from Dubai for HMS 1 are being reported limited as the availability of labour for loading and transportation usually turns difficult amid Ramadan affecting the supply. However, offers are expected to be rangebound at around USD 328-332/MT, CFR. South African HMS 1&2 assessed at around USD 330/MT, CFR Qasim.

Local steel market observes no major change - Domestic steel market conditions remain more-or-less the same since last one months’ time. Many of mini steel mills are troubling to make significant profits since more than a quarter especially located in Lahore and Gujranwala region in Punjab. It is expected that local steel prices should move up by pushing up demand as the majority of mills are making losses.

Domestic scrap prices turn volatile - Domestic scrap prices equivalent to Shredded was being reported at PKR 61,000-61,500/MT (USD 431-435), ex-works inclusive of taxes. However, tight local scrap supply is expected to lift prices by another PKR 500-1000/MT recently.

SteelMint’s assessment of local billet stands at PKR 78,500-79,000/MT (USD 555-558) ex-works. Rebar sales in Northern region turned down on slowdown in construction projects as prices have fallen to PKR 97,000-98,000/MT, ex-works (USD 685-692) while rebar asking rates in the Southern region are being reported at and above PKR 100,000/MT, ex-works inclusive of local taxes.

Pakistani Rupee continues hovering around 141.5 levels against US Dollar for yet another week.

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Newmont nets $100M payment related Akyem mine sale

Gold price rebounds nearly 2% on US payrolls data

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times