Indian Pellet Exports Down 25% in Apr'19 Amid Lowered Chinese Demand

Which all factors have lowered imported pellet demand from China?

1. Preference to lump over pellets: As per sources, Chinese mills were reluctant to take seaborne pellet rather preferring lumps. Chinese mills are yet to change the blend ratio hence, even after falling pellet premium; it has failed to replace lumps. As a result, pellet inventory at major ports have picked up to 5.2 MnT towards end of Apr as against 4.6 MnT towards early Mar'19.

2. Weaker demand amid domestic (China) pellet availability: Due to less environment restriction in China, limited pellet inquiries came for Indian pellets from Chinese mills. They are very much comfortable to use domestic pellets due to cost-effective measures.

3. Preference for low grade ore: Amid shrinking steel margins, Chinese mills prefer low-grade iron ore and concentrate rather than going for high-grade ore & pellets. Also, amid limited production curbs in China post Mar, and April being marked with highest construction activities in China, the mills increase usage of low grade ore.

Indian pellet export volumes to China fall

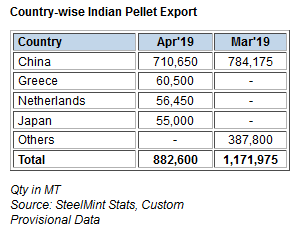

China continued to remain the largest importer of Indian pellets for the month with the quantity of 0.71 MnT, down by 9% as against 0.78 MnT in Mar'19. Greece stood the 2nd largest importer of Indian pellet at 0.06 MnT followed by Netherland and Japan at 0.06 MnT each.

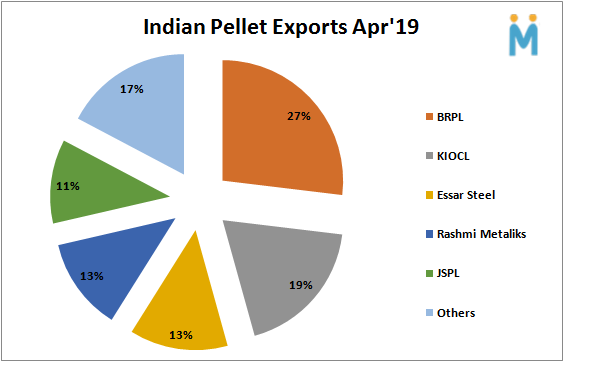

BRPL remains the largest Indian pellet exporter

BRPL stood the largest pellet exporter in Apr'19 with exports at 0.24 MnT, up 4% as against 0.23 MnT in Mar'19.

KIOCL stood second largest exporter at 0.17 MnT (down 28% M-o-M), followed by Essar Steel at 0.12 MnT and Rashmi Metaliks at 0.11 MnT.

Other exporters were JSPL, Godavari Power, and others.

Paradeep port accounted for largest export share for the month :

Pellet exports from Paradeep port recorded highest in Apr'19 at 0.40 MnT against 0.41 MnT in Mar'19, followed by Dhamra port at 0.17 MnT (down 51%), Mangalore port at 0.17 MnT (down 28%) and Gangavaram at 0.10 MnT.

Outlook : As per SteelMint Analysis, Indian pellet exports is expected to increase. This is due to the steel making hub of China, Tangshan has extended steel production curbs till Sep this year. Also, as per reports received to SteelMint, China's Hebei province this year will shut down 40 mines (other than coal mines) and 51 tailings dams.

Besides, Indian pellet exports to non-Chinese market may pick up amidst rising deals to export pellet. (KIOCL) has signed a tripartite MoU with Emirates Steel, Abu Dhabi, and Star Global, Dubai for sale of high-grade pellets to Emirates Steel. KIOCL has also signed MoU for the supply of pellets to Japan's JFE Steel for the supply of 200,000 MT pellets.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge