Turkey: Imported Scrap Prices Soften on Limited Deals

Surprisingly not many deals have been reported for Ramadan restocking. While participants remain uncertain whether remaining May shipments buying will pick up not before moving towards slowdown on account of Ramadan month starting from 5th May.

In a single deal reported so far this week, an Istanbul based steelmaker has booked a cargo from US-based supplier for June delivery, comprising 22,000 MT HMS 1&2 (90:10) at USD 305.50/MT, 13,000 MT of Shredded at USD 308.50/MT and 5,000 MT of Bonus scrap at USD 313.50/MT, CFR. This cargo puts US origin HMS 1&2 (80:20) equivalent at around USD 302-303/MT, CFR.

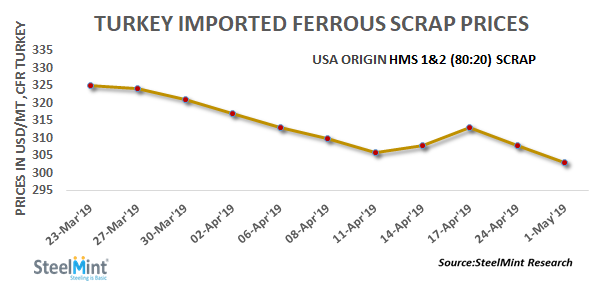

According to SteelMint’s assessment, US origin HMS 1&2 scrap has dropped to USD 302-303/MT, CFR Turkey, down USD 4-5/MT against last week. While prices have moved down by around USD 10/MT against USD 312-313/MT reported two weeks earlier. An assessment of Europe origin stands at around USD 298-300/MT, CFR. A premium of US material over Northern European scrap stands at around USD 3-4/MT.

It was earlier expected that the country’s limited scrap inventory for May working would lead to restocking of scrap ahead of Ramadan, thus slightly rising prices further. However, hardly a couple of trades being concluded has led to the price drop amid continued low finish steel demand. Many steel mills to eye for USD 295-300/MT levels for scrap to make profits at current rebar price levels in the market.

Turkish rebar export demand remained slow and export offers marginally dropped to USD 475-480/MT, FoB with no major deals seen yet.

Codelco seeks restart at Chilean copper mine after collapse

Hudbay snags $600M investment for Arizona copper project

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling