South Asia: Imported Scrap Trades Pick up in Pakistan; India Silent

Bangladesh’s restocking trades are yet to pick up but are expected to resume in upcoming days.

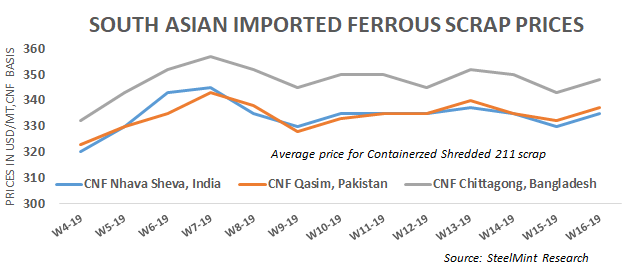

Pakistan observes active booking for Shredded scrap - Few steelmakers in Pakistan have recently booked considerable quantities of Shredded scrap in containers at around USD 335/MT, CFR Qasim majorly from US and UK. But those with inventories in hand have remained less interested on shaky global sentiments.

Traders were offering Shredded scrap at around USD 337-340/MT, CFR Qasim.

“Pakistan's imported scrap market has picked up and restocking has started ahead Ramadan holidays, however, a sudden increase in offers and tonnages being offered from suppliers’ side in the market keep few buyers hesitant seeking more clarity on global sentiments.” shared a source.

Indian imported scrap prices unchanged on W-o-W - SteelMint’s assessment for containerized Shredded from Europe, UK and US stand at USD 335/MT, CFR Nhava Sheva. P&S scrap is majorly being offered at around USD 350/MT, CFR India and USD 360/MT, CFR Bangladesh.

South African HMS 1&2 and HMS 1 from Dubai traded at around USD 334-335/MT, CFR while few trades of Dubai HMS 1 concluded at around USD 330/MT, CFR depending on quality.

India observed trades for low priced ferrous scrap - According to sources report, India has observed deals for low priced HMS scrap from various origins like West Africa, Brazil and Germany. SteelMint’s assessment of West African HMS 1&2 in 20-21 MT containers remained almost stable at around USD 310-313/MT, CFR Chennai and Goa while around USD 315-316/MT, CFR Nhava Sheva.

Brazil origin HMS 1&2 booked at around USD 320/MT, CFR and European HMS scrap at around USD 305-310/MT, CFR depending on quality. Depreciation of INR against USD has resulted in higher freight variable to India this week.

Domestic scrap prices remain volatile on a weekly basis - Price assessment of local HMS 1&2 (80:20) scrap stands at INR 24,900-25,100/MT (USD 356-359), ex- Mumbai and INR 24,200-24,400/MT, CFR Chennai slightly down by INR 200-400/MT against last week report. USD/INR exchange rate slightly increased to 6 weeks’ high to 70.2 observing depreciation INR against USD which could also have kept Indian buyers away from buying.

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Newmont nets $100M payment related Akyem mine sale

Gold price rebounds nearly 2% on US payrolls data

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times