Chinese Steel Market Highlights - Week 16, 2019

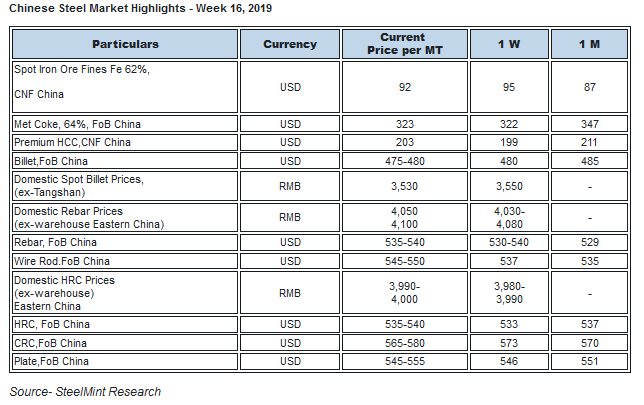

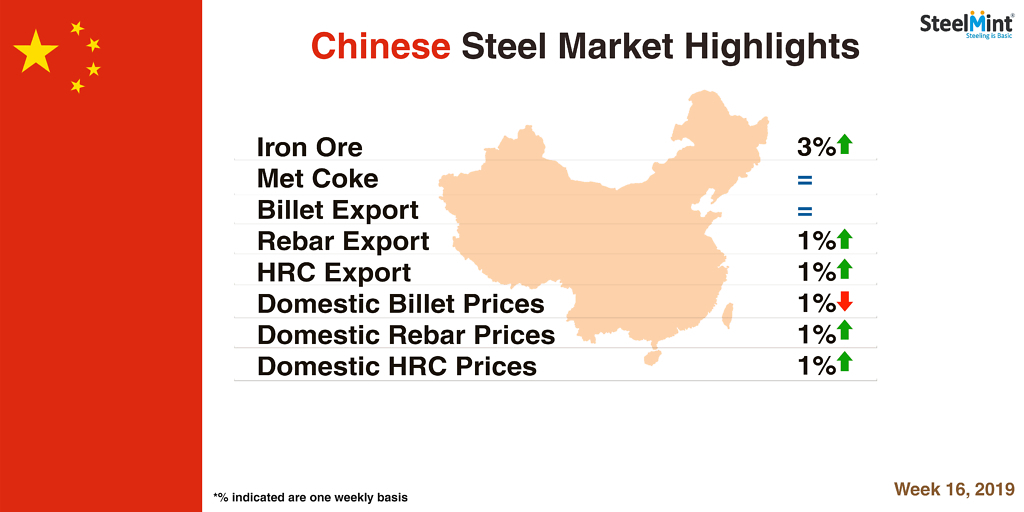

HRC and rebar export offers moved up marginally. Coking coal offers moved up over improved buying from China. Iron ore prices declined towards the weekend.

As per the recent data released by NBS (National Bureau of Statistics) China’s crude steel production reported increase of 8% in Mar’19 to 80.33 MnT which was 74.58 MnT in Feb’19.

However China witnessed fall in crude iron ore production in Q1 CY19. The production in first quarter CY19 recorded at 188.32 MnT, down 9% against 206.13 MnT in last quarter (Q4 CY18).

Chinese spot iron ore prices fall as supply eases - Chinese spot iron ore prices opened up this week at USD 95.8/MT, CFR China and dropped to USD 91.8/MT towards the weekend amidst easing supply concerns from Vale.

Brazilian miner - Vale announced resumption at its Brucutu mines (capacity of 30 MnT pa) on 17th Mar. Iron ore inventory at major Chinese port dropped to 140 MnT this week as against 143.9 MnT towards last weekend.

Spot lump premium remain stable on weekly basis- Spot lump premium witnessed stable on weekly basis at USD 0.3150/DMTU, CFR China.Lump inventory at major Chinese ports has dropped on weekly basis to 16.2 MnT assessed on 19th Apr as against 16.6 MnT on 12th Apr.

Spot pellet premium up slightly W-o-W-:Spot pellet premium for Fe 65% grade pellets increased to USD 29.25/DMT, CFR China this week, against 28.40/DMT a week before. Pellet inventory at major ports have dropped to 4.9 MnT this weekend against 5 MnT a week before. The steel making hub of China, Tangshan has extended steel production curbs till Sep this year which may results to improved demand for pellets.

Coking coal offers rebound amid improved buying from China: Seaborne coking coal prices rebound in Australia amid improved buying from steel mills in China.

Meanwhile the supply situation of premium coking coal has been normalized with improving weather conditions in Australia which leads to increase in coking coal prices.

Also Indian demand for imported coking coal remain healthy, with most end-users looking forward to book cargoes for May-June deliveries.

Thus, latest offers for the Premium HCC grade are assessed at around USD 206/MT FOB Australia which was reported USD 201.75/MT FoB basis last week.

Chinese billet prices fell towards week close - Chinese billet prices in domestic market inched up to RMB 3,580 /MT towards the mid week but amid dull trades, prices fell to RMB 3,530/MT (including VAT) towards the week close.

Chinese HRC export offer edged up over gains in domestic market-Strengthening sentiments in domestic market amid increased buying and robust demand pushed up prices in upward direction.

Following this HRC export offers edge up by USD 5-10/MT on weekly basis.

Currently nation’s HRC export offer is assessed at around USD 535-545/MT FoB basis. Last week the offers stood at USD 530-535/MT FoB basis.

Meanwhile prices in domestic market surge by RMB 10/MT on weekly basis.Domestic prices in eastern China (Shanghai) stood at RMB 3990-4000/MT inclusive of VAT taxes.

Chinese mills are trying to focus in domestic market amid improved demand majorly driven by automotive and heavy machinery sectors.

Chinese rebar export offer edges up on weekly basis- This week nation’s rebar export offers moved up on weekly basis following uptrend in domestic prices.

Nation’s rebar export offers are at USD 535-540/MT FoB China.Last week also the offers were at USD 530-540/MT FoB basis.

Domestic rebar prices moved up 20/MT on weekly basis and is assessed at RMB 4,050-4,100/MT in (Eastern China) inclusive of VAT taxes.

Buyers in domestic market are actively selling the material owing to higher profit margins since they have restocked the material in March and April.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Goldman told clients to go long copper a day before price plunge

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project