India: Tata Steel Concludes Purchase Tender for Imported Ferrous Scrap

The steelmaker had issued a RFQ (Request for Quotation) for procurement of 20,000 MT imported scrap during mid of Mar’19, out of total issued quantity, 15,000 MT was HMS 1 and 5,000 MT Shredded on CIF Vizag port (India east coast) and was to be sourced through e-auction platform, M-Junction. The payment terms of the tender are on 100% LC basis with 90 days issuance from the date of the bill of lading.

According to sources, out of total 20,000 MT, only 12,000 MT of scrap has been purchased at an average price of Shredded at USD 355/MT and HMS 1 at USD 345/MT on CFR Vizag port basis while around USD 3-4 can be considered as an additional cost of interest on 90 days LC to suppliers cost.

The company to float another scrap tender shortly - This was the second tender floated by the company for the purchase of imported scrap. SteelMint learned from sources that the company likely to float another tender for purchase of around 15,000 MT scrap in next couple of days.

Who is Tata Steel BSL? In 2018, Tata Steel acquired Tata Steel BSL Limited (formerly known as Bhushan Steel Limited) through its wholly owned subsidiary and steel production capacity of 5.6 MnT pa.

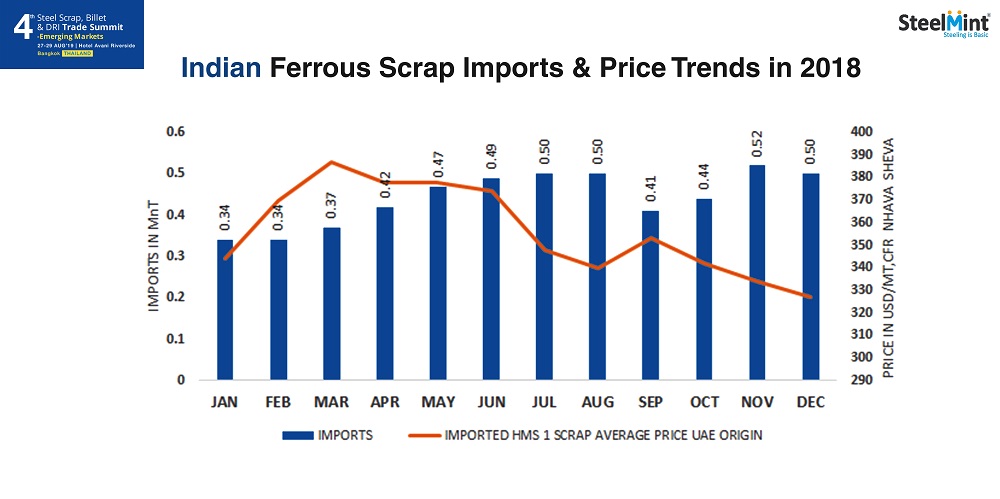

Indian imported scrap trades remain slow ahead of elections - Indian imported scrap market observed slow trades on upcoming elections and less cash inflow. SteelMint’s assessment for containerized Shredded from UK, Europe and US stands at around USD 330/MT, CFR Nhava Sheva and HMS 1 from Dubai at around USD 325-330/MT, CFR depending on quality. Few participants shared that sentiments for imported scrap are not aggressive as soon after the election (mid-April-end May), starting of monsoon season in the country likely to keep major construction projects in slow pace which may put pressure on imported scrap demand.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift