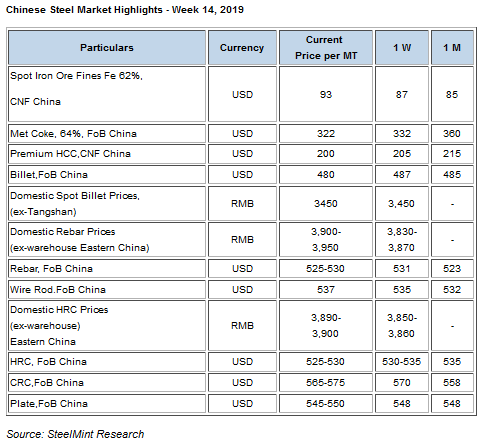

China Steel Market Highlights - Week 14, 2019

Meanwhile coking coal prices fell amid lowered Chinese buying interest. Meanwhile billet export offers fell on weekly basis. However iron ore prices reported surge on supply concerns.

Under the schedule for the non-heating season, sintering and pelletising machines of Category A steel mills will face cuts of 20%.

With the end of winter heating season in March, Steelmakers in China's largest steel producing city Tangshan and another city Handan will be required to cut steel capacities on environmental concerns. According to the market sources, steel mills in Tangshan will be divided into three regions and each region will take turns to curb excess output and based on the estimates, the average production cuts would be around 20% throughout April to June.

As per reports received to SteelMint, China's Hebei province this year will shut down 40 mines (other than coal mines) and 51 tailings dams. On March 29, the non-coal mine working conference was held in Shi Jiazhuang, the provincial capital of Hebei province.

Coking coal prices continued to remain on downside- Seaborne coking coal prices is showing downtrend since past few weeks following the emergence of lower offers across markets.

Meanwhile seaborne materials are cheaper compared to domestic coal of similar specifications. This results to fell in coking coal offers from Australia.

Thus, latest offers for the Premium HCC grade are assessed at around USD 199/MT FOB Australia which was reported USD 207/MT FoB basis last week.

Chinese spot iron ore prices surge- Chinese spot iron ore prices opened up this week at USD 87.90/MT, CFR China and increased to USD 93.10/MT towards the weekend amidst supply concerns in global market.

Besides this, major iron ore miners (Rio Tinto, FMG, Vale and BHP Billiton) decreased their sales estimates for the year. Also, as per reports received to SteelMint, China's Hebei province this year will shut down 40 mines (other than coal mines) and 51 tailings dams.

Spot lump premium witnessed dropped to USD 0.3200/DMTU, CFR China as against USD 0.3285/DMTU, CFR China a week ago. The lump premium has dropped amidst availability of cheaper substitutes and mills were replacing lumps with pellets.

Lump inventory at major Chinese ports has increased on weekly basis to 16.9 MnT assessed on 4th Apr as against 16.6 MnT towards last weekend.

Spot pellet premium down by USD 8.20/DMT this week- Spot pellet premium for Fe 65% grade pellets have dropped to USD 25.35/DMT, CFR China this week, against 33.55/DMT a week before. However, the steel making hub of China, Tangshan has extended steel production curbs till Sep this year which is expected to lead to enhanced pellet demand.

Chinese HRC export price inch down this week despite gains in domestic market- Chinese HRC export offers inched down this week despite gains in domestic market.

Currently nation’s HRC export offers is assessed at around USD 525-530/MT FoB basis. Last week the prices stood at USD 535-540/MT FoB basis.

Prices in domestic market moved up by RMB 40/MT on weekly basis. Domestic prices in eastern China (Shanghai) stood at RMB 3,830-3,850/MT inclusive of VAT taxes.

Meanwhile China steel market is on holiday mood amid Qingming festival (Tomb Sweeping Day) from 5th Apr’19 to 7th Apr’19.

Chinese rebar export offers move down slightly- This week rebar export offers reported slight decline in its export offers amid of public holidays in China.

Currently, nation’s rebar export offers are at USD 525-530/MT FoB China. Last week also the offers were at USD 530/MT FoB basis.

Meanwhile domestic rebar prices moved up by RMB 70/MT on W-o-W basis and is assessed at RMB 3,900-3,950/MT in (Eastern China) inclusive of VAT taxes.

Last week the prices stood at RMB 3,830-3,870/MT inclusive of VAT taxes.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling