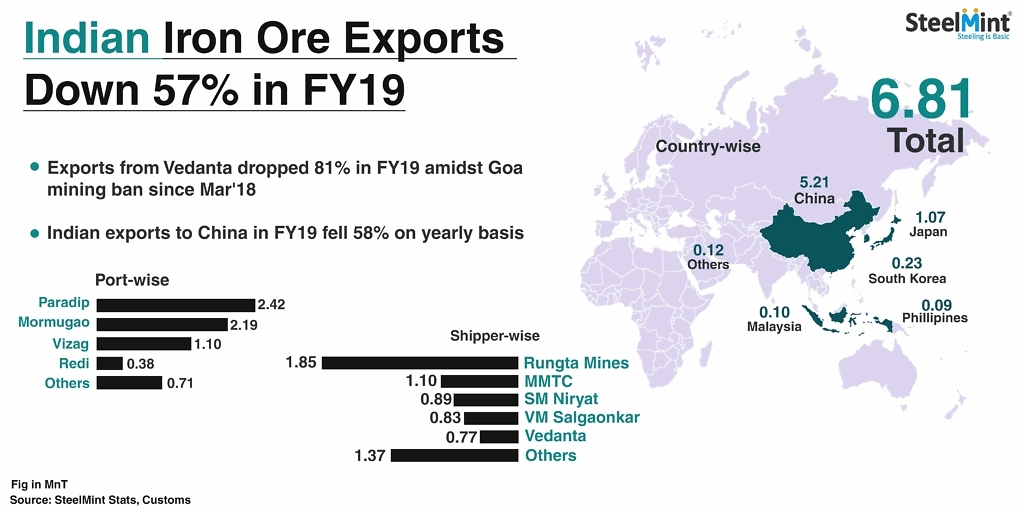

Indian Iron Ore Exports Plunge 57% in FY19

However, in the month of Mar’19, the exports increased significantly to 1.19 MnT as compared to 0.33 MnT in Feb’19 amid increased demand for low-grade ore from China on shrinking steel margins.

Why Indian iron ore export volumes dropped in FY’19?

Goa mining ban impacted export volumes adversely: Operation at Goan mines was put to halt owing to illegal mining case post-Mar ’18. The mines were permitted to export iron ore mined previously to the ban imposition (15th Mar’18), on which royalty was paid, and material lying at jetties, with the halt in new mining operations. This resulted in declining exports from Goa since Mar’18 and recorded no exports post June ’18.

Delay in resumption of exports from NMDC: NMDC’s LTA (Long-term agreement) to export iron ore to South Korea and Japan had expired owing to which the miner recorded nil exports for a period of five months from Apr’18 to Aug’18. On 25th April’18, NMDC received approval for supply of iron ore to Japan and South Korea for a period of three years i.e from Apr’18 to 31 Mar 2021. Later the miner resumed exports in Sep’18.

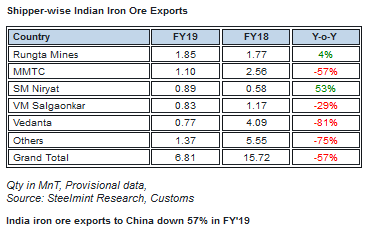

Rungta Mines turned out to be India’s largest iron ore exporter in FY'19

Rungta Mines stood largest iron ore exporter in FY’19 at 1.85 MnT, up 5% Y-o-Y as against 1.77 MnT in FY18. MMTC (which exports on behalf of NMDC) exports dropped 57% to 1.10 MnT in FY’19 amidst delay in resumption of LTA for exports leading to nil exports for a period of five months.

Exports from Vedanta fell 81% to 0.77 MnT amidst mining ban since Mar’18. Other miners Fomento Resources and Chowgule and Company dropped significantly by 87% and 66% respectively.

China continued to be the largest importer of Indian iron ore in FY’19 at 5.21 MnT. However, exports dropped 57% against 12.01 MnT in FY18, followed by exports to Japan and South Korea dropped to 1.07 MnT (down 59%) and 0.23 MnT (down 62% Y-o-Y) respectively.

Paradeep Port remained India’s largest iron ore exporting port in FY’19

In FY'19, Paradip port stood the largest exporter of Indian iron ore at 2.42 MnT, up 19% compared to 2.04 MnT in FY18. Mormugao port stood second largest exporter at 2.19 MnT, down 77% Y-o-Y.

Exports from Vizag port dropped sharply 60% to 1.10 MnT against 2.79 MnT in FY18

Barrick’s Reko Diq in line for $410M ADB backing

Pan American locks in $2.1B takeover of MAG Silver

US adds copper, potash, silicon in critical minerals list shake-up

Gold price gains 1% as Powell gives dovish signal

Gold boom drives rising costs for Aussie producers

Giustra-backed mining firm teams up with informal miners in Colombia

Energy Fuels soars on Vulcan Elements partnership

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook