Indian Steel Market Weekly Snapshot

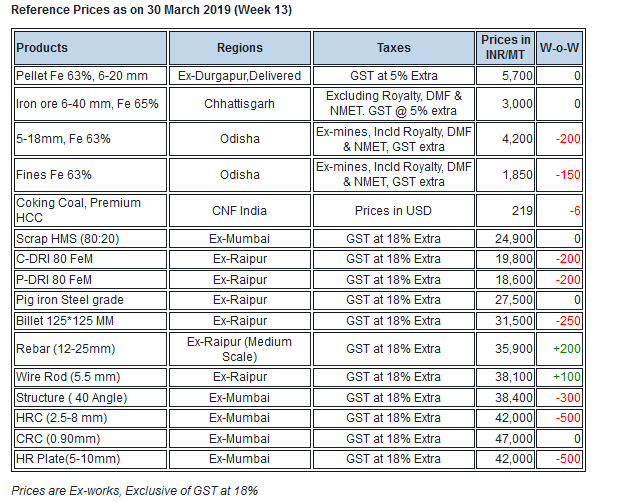

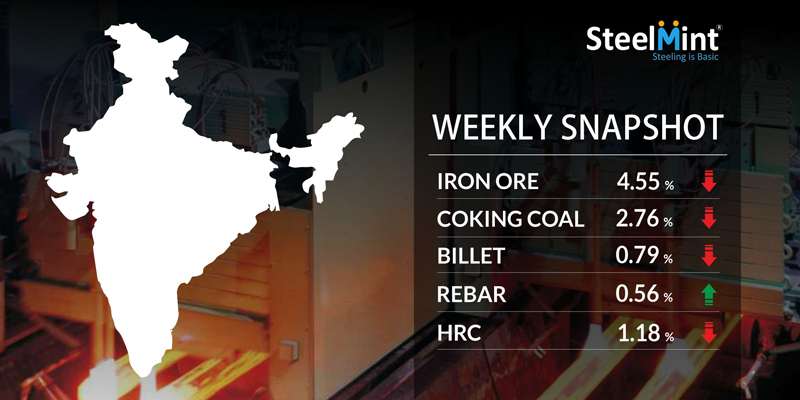

As per SteelMint's assessment, in these days the prices of Semis products slump by INR 100-600/MT (upto USD 9). Inline Finished Long steel products registered price fall upto INR 500/MT through the mid sized mills.

Meanwhile Flat steel prices also declined in the range of INR 500-1,000/MT (USD 7-15) through the traders end.

Iron ore and Pellets

Odisha based major merchant iron ore miners are heard to have increased discounts on bulk quantity purchase and offers at around INR 1,800/MT which was earlier traded at INR 2,000/MT; (ex-mines, including Royalty, DMF & NMET) a month back. OMC reduced iron ore base prices by INR 200/MT for upcoming iron ore e-auction on 04 Apr'19.

Raipur pellet offers continue to remain under pressure amid competitive offers from Raigarh and Bilaspur. Raipur (Central India) based pellet makers keep offers firm to INR 6,300/MT. Southern India (Bellary) pellet offers for Fe 63% grade decline towards the end of this week to INR 6,800-7,000/MT (basic) against last assessment at INR 6,900-7,000/MT.

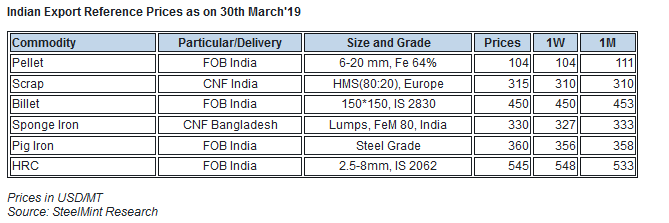

According to the market participants, seaborne pellet demand in China continued to remain slow, however, few deals of port stocks were reported at Chinese major ports at RMB 920-940/MT. No fresh seaborne pellet export deals from India were reported this week, last deal heard a week back for regular grade pellets Fe 64/63% grade with 3% alumina at USD 114-115/MT, CFR China.

Coal

Seaborne metallurgical coal prices have been edging downwards over the past two weeks with no trades taking place, as most Chinese buyers refrained from actively procuring imported cargoes, on expectations of a weakening market ahead. Market sources indicated that prices for various types of domestic coal in the Chinese market would soften. Nevertheless, seaborne coking coal prices are competitive at present, compared to domestic coking coal of similar specifications.

-- In China, a typical demand pick-up post-Lunar New Year has not materialised yet this year, as China appeared to be in wait-and-see mode, which has kept spot prices relatively stabilized so far this year in contrast to last year’s sharp uptick. Hence, coking coal supply levels remain sufficient to outweigh the limited demand appetite, which has exerted a lot of pressure on May and June forward-loading cargoes.

-- Latest offers for the Australian Premium HCC grade are assessed at around USD 218.95/MT & for the 64 Mid Vol HCC grade are assessed at around USD 187.20/MT, CNF India.

Scrap

Indian imported scrap market activities remained limited on poor cash flow amid financial year closing and the upcoming election. Domestic trade sentiments remain volatile on fluctuating INR against USD. Offers edged up marginally against last week on tight supply situation and pick up in demand from other subcontinent markets.

-- SteelMint’s assessment for containerized Shredded stands in the range USD 335-340/MT, CFR Nhava Sheva. HMS 1 from Dubai traded at around USD 328-330/MT, CFR while West African HMS 1&2 prices climbed to USD 310/MT, CFR Mundra and USD 315/MT, CFR Chennai on improved interest from Bangladesh. HMS 1 from the UK was being offered at around USD 320-322/MT, CFR

Semi Finished

On weekly basis Semi finished offers declined slightly, domestic Billet offers fall by INR 100-600/MT & Sponge iron by INR 100-200/MT.

-- Indian induction grade billet (100*100 mm size) export offers to Nepal are reported at USD 445-450/MT (ex-mill at West Bengal), equivalent to USD 475-480/MT CFR Nepal (Raxaul border).

-- Indian Sponge iron export offers firm & hovering at USD 330/MT CNF Chittagong, Bangladesh (78-80 FeM, lumps grade).

-- SAIL’s Rourkela Steel Plant tender held today (27th Mar'19) to sell about 5,900 MT steel grade pig iron, had received moderate response. The base price for the tender was quoted by RSP at INR 26,450/MT and near about 38% (2,200-2,300 MT) material sold.

-- Jindal Steel and Power (JSPL) in press release on 25th Mar’18 reported that, the producer has re-started 1.8 MnT (per annum) Sponge iron plant at Angul steel complex, Odisha.

-- Jindal Steel is offering Pig iron (steel grade) at INR 27,500-27,600/MT ex-Raigarh & Panther shots (Granulated Pig iron) at INR 25,500/MT ex-Angul, Odisha.

-- MMTC cancels Pig iron export tender of 30,000 MT owing to high expectations, whose due date for submission of bids was till 26 Mar’19. As per sources the bids was heard at around USD 360/MT, FoB India.

-- SteelMint's Pig iron export price assessment stood at USD 359-361/MT FoB India, USD 339-341/MT FoB Brazil & USD 349-351/MT FoB Black sea. Offers rise by USD 5/MT W-o-W.

Finish Long

Indian Finish long steel market seems to have volatile amid uncertain direction due to fiscal year closing & election season in the country.

As per assessment, the price range were reduced by INR 200-400/MT towards the beginning of week, however some improved sentiments noticed in specified locations and inventory levels slightly down by the end of week.

Although industry participants are still curious for coming week for the market direction, whether the positive trends will maintain for long term or short term.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 37,400-37,700/MT Ex-Jalna & INR 35,800-36,100/MT Ex- Raipur; basic & excluding GST.

-- In the week, Central region, Raipur based heavy structure manufacturers have maintained trade discount to around INR 400-600/MT and current trade reference prices at INR 39,200-39,600/MT (200 Angle) ex-work.

-- The large mills are offering 12 mm rebar at around INR 41,000-41,500/MT in South region & Wire rod stands at close to INR 42,000/MT Ex-Chennai.

Flat Steel

This week domestic HRC prices corrected by INR 500-1,000/MT in traders market. Upcoming general assembly elections, end of fiscal year combined with cheaper imports have kept Indian domestic HRC prices under pressure.

Current trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42,000/MT ex-Mumbai, INR 41,800/MT ex-Delhi & INR 44,000/MT ex-Chennai. The prices for CRC (IS513) 0.9mm is hovering at INR 47,000/MT ex-Mumbai, INR 45,800-48,200/MT ex-Delhi & INR 50,500/MT ex-Chennai. The prices mentioned above are basic, excluding GST@18% on cash payment basis.

Arrival of HRC shipments from Iran have also kept domestic HRC prices under pressure. These shipments were booked in the month of Jan’19 at USD 450-455/MT CFR basis. Thus landed cost of imports are cheaper than prevailing domestic prices.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Copper price slips as unwinding of tariff trade boosts LME stockpiles

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Fresnillo lifts gold forecast on strong first-half surge

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

What’s next for the USGS critical mineral list

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations