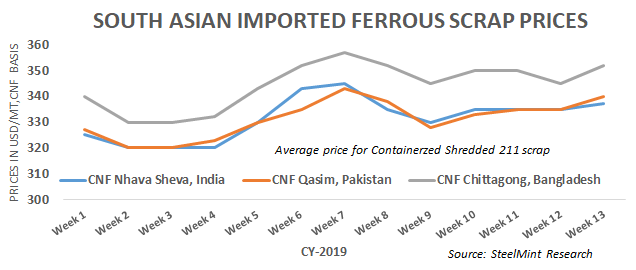

Imported Scrap Activities Pick Up in Pakistan & Bangladesh; India Remains Silent

Indian imported scrap market subdued on upcoming election - India has continued observing a slight disparity in bids and prevailing offers for imported scrap. Offers have been moved up marginally and trades are being reported very slowly this week. Finished steel demand remained dull and domestic billet prices continued downtrend.

SteelMint’s assessment for containerized Shredded from Europe, UK and US stand in the range USD 335-340/MT, CFR Nhava Sheva. Suppliers expectation remain around USD 340/MT, CFR however, no major deal concluded at these levels.

Sources shared that sellers may offer Shredded USD 335-337/MT, CFR level for offload cargoes but it has become very difficult to find fresh cargo at lower levels on tight availability in the global market despite marginal softening of Turkish prices.

In the beginning of the week, trades for HMS 1 from Dubai has reported at around USD 328-330/MT, CFR Nhava Sheva, up USD 3-5/MT against the last report. However, offers for HMS 1&2 from are being reported very less on some issues regarding exports from South Africa.

West African HMS 1&2 traded in 20-21 MT containers at around USD 308-312/MT, CFR Mundra and around USD 315/MT, CFR Chennai. However, few offers are being quoted above these levels on increased buying from Bangladesh.

HMS 1 from UK is being reported at USD 320-322/MT, CFR and sheared HMS at around USD 315/MT, Nhava Sheva from Europe and UK origin.

Indian Rupee remains volatile this week against USD - USD/INR exchange rate remained volatile between low 68.5 to high 69.3 on weekly premises. Price assessment of local HMS 1&2 (80:20) scrap remain volatile this week and stands at INR 24,700-24,900/MT (USD 356-359), ex- Mumbai today the same as the last week.

Pakistan imported scrap prices up on improved local steel prices - Sources shared that Pakistan scrap importers have turned active on improving local steel prices and less inventories in hand ahead of Ramadan slowdown.

A trading company confirmed trade of 5,000 MT Shredded scrap from UK & Europe in containers at USD 340-342/MT, CFR Port Qasim. SteelMint’s price assessment for Shredded scrap stands at around USD 338-340/MT, CFR Qasim. Asking rates for Shredded from UK and Europe reported in the range USD 340-342/MT, CFR.

HMS 1 from UAE is assessed at USD 330-335/MT, CFR and Bala billet prices were reported last at around PKR 80,000-80,500/MT (USD 549-553), ex-work inclusive of local taxes.

Bangladesh imported scrap offers edge up after bulk bookings - Bangladesh witnessed two bulk cargo bookings from US origin at USD 360-365/MT, CFR comprising largely Shredded scrap. According to sources, Bangladesh prefers high-quality scrap bookings especially Shredded on quality concerns and steel mills might have paid high prices as the supply of Shredded remains tight amid high local demand in the US market.

SteelMint's price assessment for containerized Shredded scrap stands at USD 350-355/MT, CFR Chittagong. Containerized HMS 1 from Chile and Brazil is being reported at around USD 335-340/MT, CFR. Shipyard scrap prices assessed at BDT 37,500-38,000/MT (USD 445-451) ex-yard.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling