Indian Steel Market Weekly Snapshot

Towards the beginning of week, the prices on down trend due to weak demand. However by the end of week it finds support on improved demand from local market.

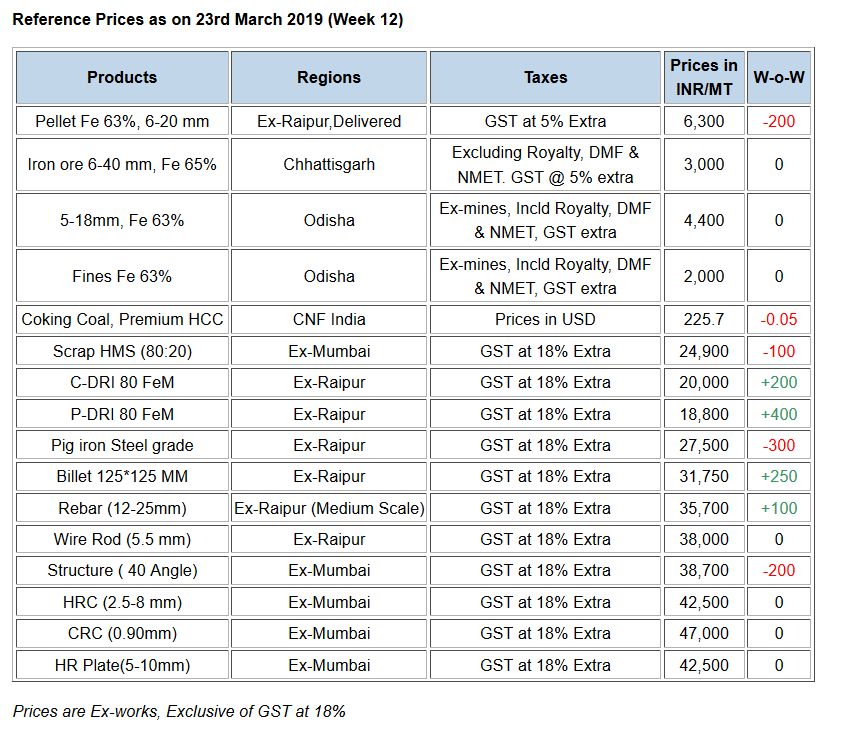

As per assessment, in this week - Semis (Billet & Sponge iron) & Finish long steel (Rebar) market registered price movement of INR 200-500/MT. However Flat Steel market observed stability in prices.

In context to raw materials (Iron ore & Pellet) marked slight fall in prices due to weak demand.

Iron ore and Pellets-:

Essel Mining - a major iron ore mine in Odisha has reduced iron ore lumps offers by INR 300/MT (USD 4/MT) & INR 150/MT in fines (USD 2/MT) w.e.f 22nd Mar’19.

-- Indian pellet offers have decreased further this week amid softening sponge market & lowered pellet buying interest at current offers. Central India, Raipur based pellet makers reduced offers last week by INR 400/MT (Ex-Raipur) to INR 6,300/MT. SteelMint’s current pellet assessment for Durgapur is around INR 5,600-5,800/MT as compared to INR 6,000-6,200/MT last week.

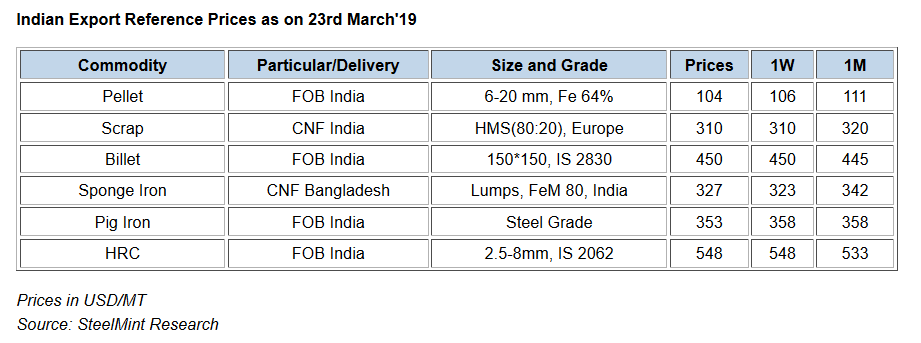

-- Inquiries for seaborne pellet cargoes from Chinese mills which remained subdued since almost a month’s time has observed some signs of improvement this week. Indian pellet export prices have fallen in recent deals concluded. An eastern India based pellet maker has concluded deals for two cargoes carry 50,000 MT pellets each (Fe 64/63% grade with 3% alumina) at USD 114-115/MT, CFR China for both the shipments in March’19.

Coal

Seaborne metallurgical coal prices have remained fairly stable over the past, with most Chinese buyers holding back restocking activities, although seaborne coking coal prices continue to be competitive, compared to domestic coking coal of similar specifications.

Nevertheless, the seaborne coking coal market had seen a flurry of fresh bookings done in the spot market last week, for mainly premium cargoes with forward laycan.

A lack of sustainable demand for raw materials – despite rising steel prices – in the downstream Chinese market has exerted downward pressure on prices for seaborne coking coal cargoes.

The Chinese buying interest has remained relatively low with no signs of urgent requirements heard as of late, possibly in light of the persistent uncertainties over port restrictions in North China.

-- Latest offers for the Premium HCC grade are assessed at around USD 225.70/MT, CNF India.

Scrap

Indian imported scrap market silent on holiday mood - Indian scrap importers remained less active for imported scrap bookings amid local festival holidays and coming election winds affected buying interest; keeping buyers away from booking in large volumes.

-- SteelMint’s assessment for containerized Shredded stands at USD 333-335/MT, CFR Nhava Sheva. HMS 1 from Dubai assessed at around USD 323-325/MT, CFR while West African HMS 1&2 prices have softened marginally to USD 300-305/MT, CFR Mundra.

Semi Finished

Indian Billet market registered volatility in prices, in which prices in Central, East & Northern regions have increased by INR 200-500/MT, while in same proportion down trend being observed in South & Western parts of the country.

Moreover, Sponge iron offers maintained stability in Southern region, meanwhile it rally in Central & Eastern regions(Durgapur) by INR 100-300/MT & INR 800-1,000/MT, respectively on W-o-W basis. The prices in Eastern region increased on account of surge in Billet prices.

Inline pig iron, private mills reduced prices by INR 400-700/MT (USD 5-10) due to weak demand. Steel grade pig iron offers in Raipur & Durgapur stood at INR 27,500-27,600/MT ex-plant.

-- Indian sponge iron export offers for 78-80 FeM, hovering at USD 330/MT CNF Chittagong, Bangladesh.

-- Indian mid sized mills export offers to Nepal surge by USD 5-10/MT and stood at around USD 455/MT for Billet (100*100 mm) & USD 530-535/MT for Wire rod (5.5 mm) ex-mill at Durgapur, Eastern India. Freight cost to Nepal at around USD 30/MT CNF Raxaul border.

-- Vizag Steel (RINL) has concluded Billet export tender of 8,127 MT Billets (3 rakes) to Nepal at around USD 440-445/MT (ex-mill). Freight cost to Raxaul border (Nepal) is heard at USD 35-40/MT.

-- Neelachal Ispat (NINL) has reduced pig iron prices by INR 500/MT to INR 26,650/MT (steel grade) ex-Cuttack, Odisha, Eastern India.

-- MMTC- India’s largest and state-owned trading house, has floated export tender of 15,000 MT Billet on behalf of NINL. The due date for submission of bids is 14:30 hrs on 28 Mar’19 and bid validity is till 4th Apr'19.

-- Vizag Steel has issued a export tender of 25,000 MT basic grade steel making Pig iron for any country other than Nepal. This tender is due on 18 Mar’19 and bid validity is till 25 Mar'19.

-- SAIL’s Rourkela Steel Plant (RSP) tender held on 20 Mar'19 to sell about 9,500 MT steel grade pig iron, had received weak response. The base price for the tender was reduced by INR 200/MT to INR 26,950/MT (ex-plant) and only about 30% (2,900 MT) material have been sold.

-- SteelMint's Pig iron export price assessment this week more or less firm and stood at USD 350-355/MT FoB India, USD 330-340/MT FoB Brazil & USD 340-350/MT FoB Black Sea.

Finish Long

Indian Finish long steel market observed lack of activities, where buying inquiries was on average basis and less participation registered through the industry participants in most of the regions.

Market scenario got inactive due to festive mood and few Central region based mills still not fully operational due to absence of labor and actual market trends may clear in coming week. Participants are assuming that slight price corrections may get noticed due to weak raw materials.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 37,600-38,000/MT Ex-Jalna & INR 35,600-35,900/MT Ex-Raipur; basic & excluding GST.

-- During the week, central region based heavy structure manufacturers maintained trade discount at around INR 300-400/MT and current trade reference prices at INR 39,400-39,800/MT (200 Angle) ex-work.

-- Raipur, Central India based Wire rod mills & re-sellers have reduced trade discount and currently stood at INR 600-700/MT as against last week at INR 1,000-1,200/MT.

Further the large mills are floating some trade discount to get healthy trade volume through dealers particularly in Southern region, as per sources and current trade reference price registered at INR 41,500-42,000/MT ex-Chennai.

Flat Steel

This week Indian HRC trade prices have remained range-bound amid sluggish trades in domestic market. Market participants are in a festive mood amid holi holidays which has led to dull sentiments in domestic market.

Current trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42,500/MT ex-Mumbai, INR 42,500/MT ex-Delhi & INR 44,500/MT ex-Chennai. The prices are basic, excluding GST @ 18% on cash payment basis.

Currently trade reference prices for CRC (IS513) 0.9mm is hovering in the range of INR 46,500-47,000/MT ex-Mumbai, INR 47,000-48,000/MT ex-Delhi & INR 51,000/MT ex-Chennai. The prices are basic, excluding GST@18% on cash payment basis.

Subdued buying in the traders market, resulting under pressure domestic HRC prices.

In the beginning of this month Indian major steel mills have raised HRC & CRC prices by INR 1000-1500/MT in line with higher raw material cost and surge in global steel prices.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Goldman told clients to go long copper a day before price plunge

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge