Australia Iron Ore Exports to China Rise in Feb'19

Australia's iron ore export shipments recorded at 67.94 MnT in Feb'19, as compared to 65.54 MnT in Jan'19.

On yearly basis too, the exports increased 4% as against 65.51 MnT in Feb'18.

For CY19 (Jan-Feb'19), total iron ore exports witnessed marginal fall to 133.48 MnT as against 135.3 MnT for same period last year.

Australian exports to China up marginally in Feb'19

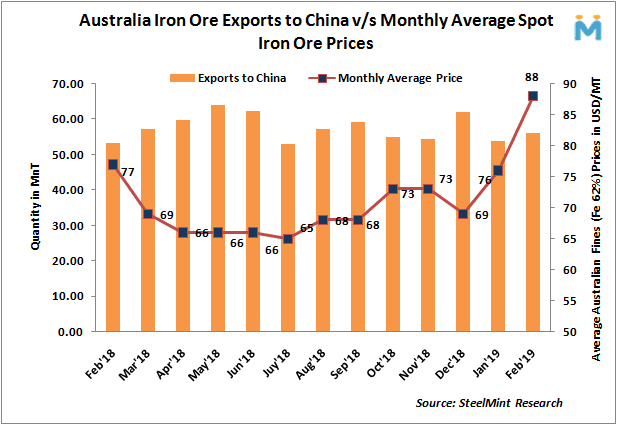

China marked the largest importer of Australian iron ore in Feb'19 at 56.05 MnT, contributing 83% of total Australian exports for the year, up 4% against 53.67 MnT in Jan'19. Amidst reduced availability of Brazilian iron ore due to Vale mishap, and expectation of better steel margins, China increased imports from Australia.

Japan stood the second largest importer at 5.06 MnT (down 2% M-o-M), followed by Korea at 3.77 MnT (down 13%).

Port Hedland iron ore exports down 5% in Feb'19

In Feb'19, Port Hedland exported 39.50 MnT, down 5% against 41.54 MnT in Jan'19, followed by Walcott at 15.64 MnT (up 23% M-o-M) and Dampier at 11.62 MnT (up 19% on monthly basis). Port Hedland is used by three of Australia's top four iron ore miners, BHP Billiton, Fortescue Metals Group and Gina Rinehart's Hancock Prospecting.

Average global iron ore fines prices up in Feb'19 due to Vale mishap

Monthly average global iron ore fines (Fe 62%) prices increased 16% to USD 88/MT, CFR China in Feb'19 compared to USD 76/MT, CFR China in Jan'19.

The Vale dam disaster followed by a series of halt at various dam and mines owned by Vale led to global shortage of material resulting in sharp rise in ore prices.

First Quantum scores $1B streaming deal with Royal Gold

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Goldman told clients to go long copper a day before price plunge

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times