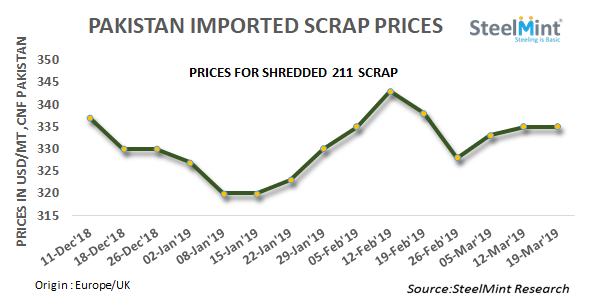

Pakistan: Imported Scrap Prices Stable in Recent Deals

Limited trades reported at stable prices, however, few participants remain seeking more clarity on the price direction in the global market.

SteelMint’s assessment for Shredded scrap stands in the range USD 333-335/MT, CFR Qasim almost stable on W-o-W basis. In recent deals confirmed from traders, containerized Shredded scrap reported having booked at around USD 333-336/MT, CFR from UK and Europe. While asking rates from the recyclers in UK, Europe and USA are being quoted in the range USD 335-337/MT, CFR.

Reports expressed that total around 10,000 MT of imported scrap is heard to have got booked so far this week, however, this volume is still below than the average and may not be enough to boost momentum in the market.

Offers for Middle East origin HMS 1 heard at around USD 330/MT, CFR Qasim. Buyers remained mostly interested in the range of USD 325-327/MT, CFR.

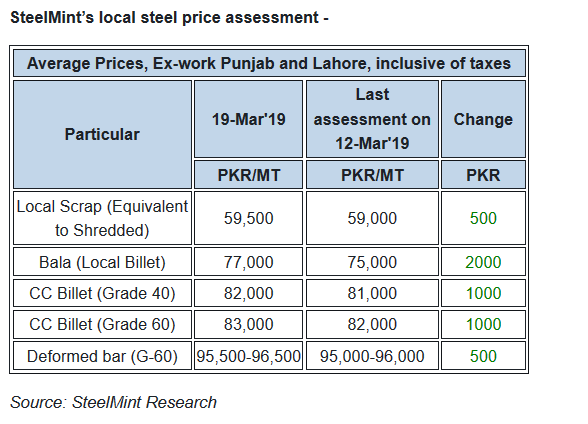

Local steel market improves gradually - Local steel market has shown a gradual improvement in terms of prices since the past two weeks, however, concerns of liquidity issues, excess supply and still lower demand are yet to be fixed yet. Local Bala billet prices increased further by PKR 1000-2000/MT (USD 7-14) this week on the back of increased rates of electricity and however, demand is still below average at the moment.

SteelMint assessed local billet prices at PKR 77,000/MT, (USD 550)ex-works against PKR 75,000/MT (USD 535) in the last weeks' report. Sources shared that ‘less inventory’ pressure, improving local steel prices and increasing the price margin between imported scrap to Bala billet which stands at around USD 210-215/MT may support scrap imports in upcoming days.

Furnaces slowly turn operational - Many of the furnaces in the Northern region were not operating fully since more than a couple of months in Pakistan on the back of losses being faced amid local issues. According to sources, some of these furnaces in north Pakistan mainly in Gujranwala have resumed back operations. Government is expected to take initiatives to stabilize the economy in the near terms and participants believe that industry will regain the better situation slowly in the next couple of weeks.

Gadani’s Shipbreaking market has been observing a drastic fall since around the last 6 months period. It remains silent in terms of fresh sales and many yards stand empty in starved of tonnage. Buyers are in an attempt to fix the challenges they face in securing competitive deals as outlook remains less impressive. SteelMint’s ship breaking assessment stands at USD 430-435/LT LDT for containers and USD 420-425/LT LDT for Tankers.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling